Shares of Boeing (BA.US) are trading over 3% higher in premarket today after the company reported financial data for Q1 2023. Results turned out to be a positive surprise. While core loss per share turned out to be deeper than expected, the company managed to deliver a solid revenue beat. Moreover, cash burn at the company is not as intense as expected with operating and free cash flow beating expectations significantly.

Q1 2023 highlights

- Core EPS: -$1.27 vs -$0.97 expected

- Revenue: $17.92 billion vs $17.43 billion expected

- Operating cash flow: -$0.32 billion vs -$1.49 billion expected

- Adjusted free cash flow: -$0.79 million vs -$1.86 billion expected

Full-year guidance (unchanged)

- Adjusted free cash flow: $3.0-5.0 billion

- Operating cash flow: $4.5-6.5 billion

- Aircraft deliveries: 400-450

Boeing reported its seventh quarterly loss in a row as the company is yet to recover from damage caused by two deadly 737 MAX crashes and subsequent groundings. Boeing said that it is producing 787 planes at a rate of 3 per month and plans to increase it to 5 per month in late-2023. The company said that recent flaws found in its 737 planes will not dent its delivery and cash-generation targets but there are concerns that it may negatively impact delivery schedules.

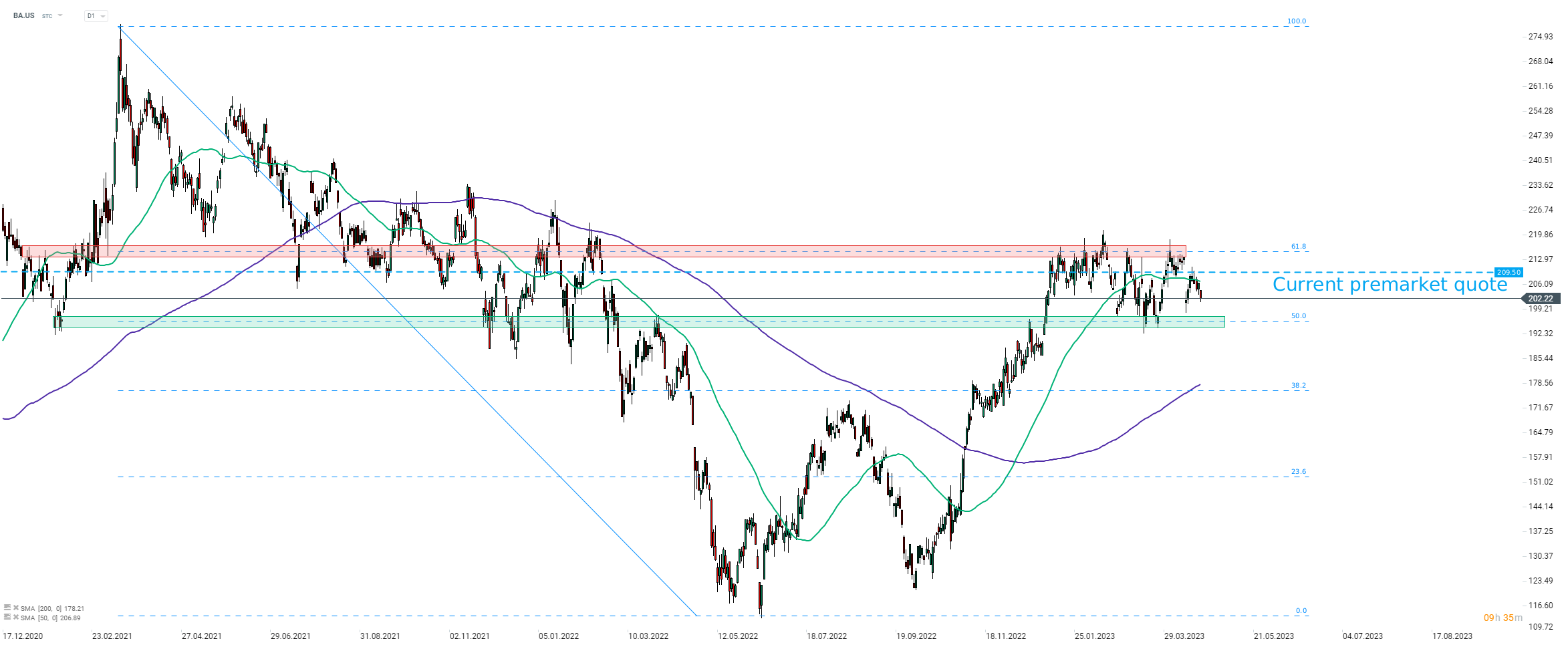

Boeing is trading over 3% higher in premarket today. Current premarket quotes point to opening of today's cash trading session near recent local highs. In such a scenario, overall technical picture for the stock would be left unchanged - price continues to trade in a range marked with 50% and 61.8% retracements and direction of a breakout would likely determine direction of the next big move.

Source: xStation5

Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡