-

BOJ kept the policy rate at 0.50% in a 7–2 split; Hajime Takata and Naoki Tamura voted for a hike to 0.75%.

-

A new step toward normalization: BOJ will begin selling its ETF (and J-REIT) holdings, with guidelines of ~¥620bn/year for ETFs, equivalent to about 0.05% of daily trading volume.

-

Following the decision, the yen (JPY) posted strong gains while Japanese equity indices fell. Markets shifted to risk-off mode, with the JP225 losing 1.90%.

-

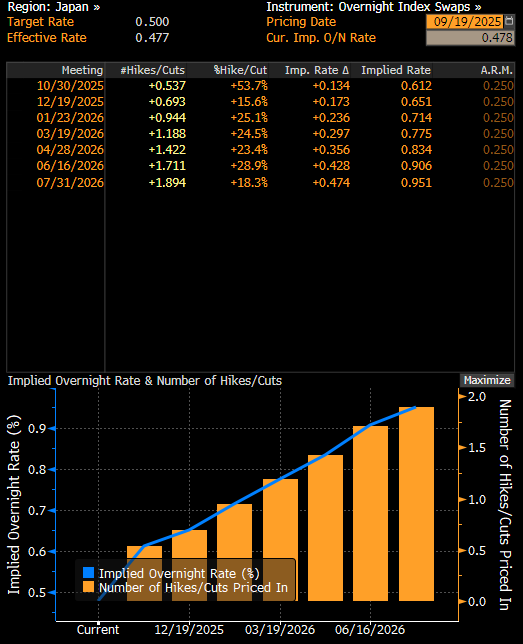

Expectations for a rate hike at the next meeting on October 29–30 rose to 55%.

BOJ’s decision to keep interest rates unchanged was widely expected by the market. What surprised, however, was the relatively hawkish tone. Two members pushed for a 25bp hike to 0.75%, signaling growing internal pressure for tightening. The shift in rhetoric reflected reduced uncertainty after Japan’s trade agreement with the US and inflation moving closer to target later in BOJ’s three-year projection horizon. Against this backdrop, markets began to price roughly 50/50 odds of a BOJ hike as early as the October 29–30 meeting.

Policy changes

Beyond rates, the new element was BOJ’s plan to reduce its exposure to risk assets. The Bank will start a gradual sale of ETFs (and J-REITs), with reports citing a level of ~¥620bn annually for ETFs. Given the size of BOJ’s current holdings, such a pace would mean the entire process taking over a century. This is by design, as the Bank aims to shrink its market footprint without disruptions.

Market reaction

Today’s BOJ decision was interpreted as a “hawkish hold.” Equities reversed lower (with particular pressure on large tech companies where BOJ’s share is significant), while banks were seen as relative beneficiaries of balance sheet normalization. USDJPY dropped more than 0.52% right after the decision, and swaps quickly repriced October hike odds to 53%.

However, this reaction was largely pared back during BOJ Governor Kazuo Ueda’s press conference. He downplayed the dissenting views of Takata and Tamura, said Japan’s economy is moderately recovering with no material declines in capex, wages, or employment, and pointed to persisting downside risks from tariffs and FX uncertainty. Ueda reiterated that BOJ will continue ETF/J-REIT sales until fully unwound (an indicative pace of 112 years). Policy remains data-dependent, with rate hikes possible if the economy and prices track forecasts. After the press conference, markets retraced the initial post-decision moves and the JPY weakened.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)