The Bank of Canada raised its benchmark interest rate by 50bps to 4.25 % as widely expected and pushing borrowing costs to the highest since 2008. Policymakers added they are also continuing their policy of quantitative tightening. Policymakers noted that economic growth remains strong although it is expected to stall through the end of this year and the first half of 2023. Also, the labour market remains tight while inflation is still too high and short-term inflation expectations remain elevated. Looking ahead, the central bank will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target, in a sign the tightening campaign could be near an end. The central bank has raised rates at a record pace of 400 bps since March.

No post-meeting press conference will be held.

Source: BoC

Source: BoC

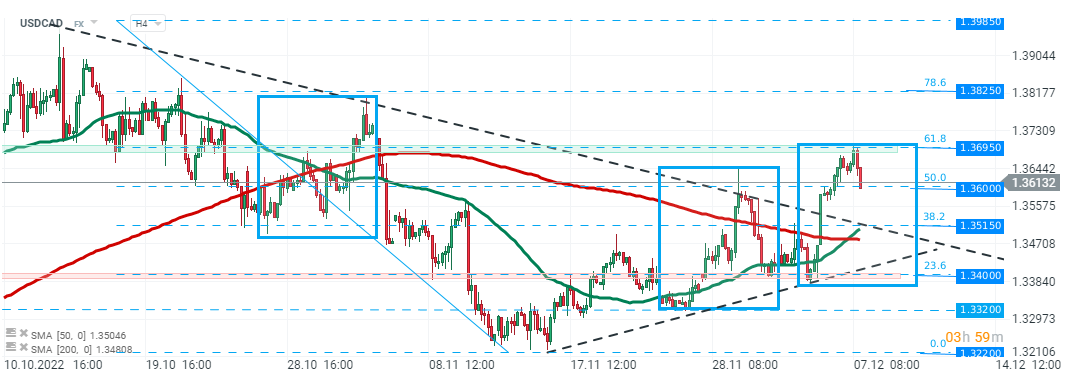

USDCAD fell sharply and is testing support level at 1.3600. Source:xStation5

Economic calendar: US CPI Inflation the Most Important Report of the Week 🔎

Market wrap (09.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)