German ZEW economic research institute released the latest set of its sentiment indices at 10:00 am BST. Data was expected to show an improvement in Expectations as well as Current Situation indices. Simultaneously, final CPI report for May for the whole euro area was released, but as it is usually the case with final releases, it was not expected to show any deviations from flash release or trigger any major market moves.

Actual ZEW data turned out to be a disappointment - Expectations subindex improved compared to May just slightly, while Current Situation subindex deteriorated. ZEW Institute said that sentiment and situation indicators stagnate and that inflation expectations of survey responded increased. Final CPI data from euro are came in-line with flash release. EUR ticked lower in a knee-jerk move but this reaction was short-lived and EURUSD trades little changed compared to pre-release levels.

Germany, ZEW indices for June

- Expectations: 47.5 vs 50.0 expected (47.1 previously)

- Current Situation: -73.8 vs -65.0 expected (-72.3 previously)

Euro area, final CPI inflation for May

- Headline: 2.6% YoY vs 2.6% YoY in first release

- Core: 2.9% YoY vs 2.9% YoY in first release

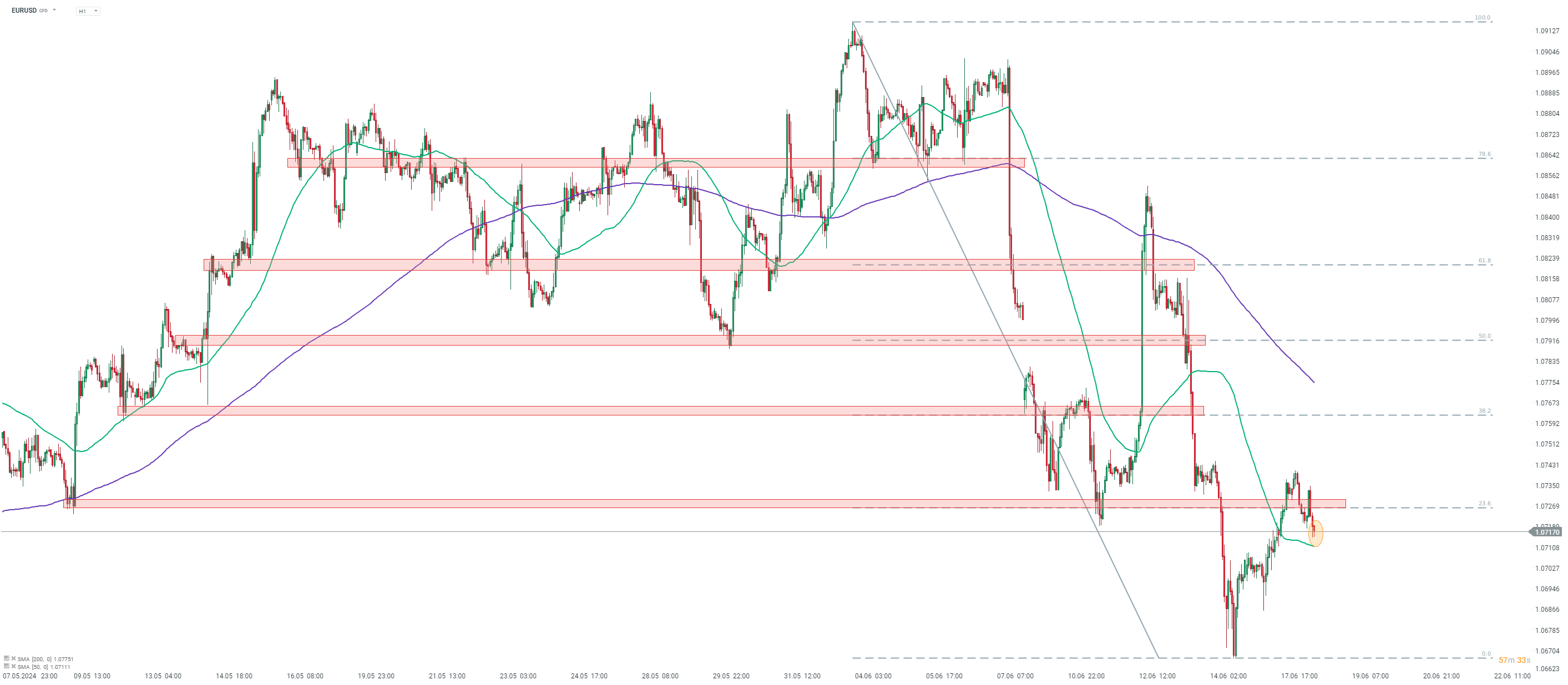

EURUSD ticked lower in a knee-jerk move in response to miss in ZEW data (orange circle). However, the move was mostly erased by now. Source: xStation5

Economic calendar: US CPI Inflation the Most Important Report of the Week 🔎

Market wrap (09.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)