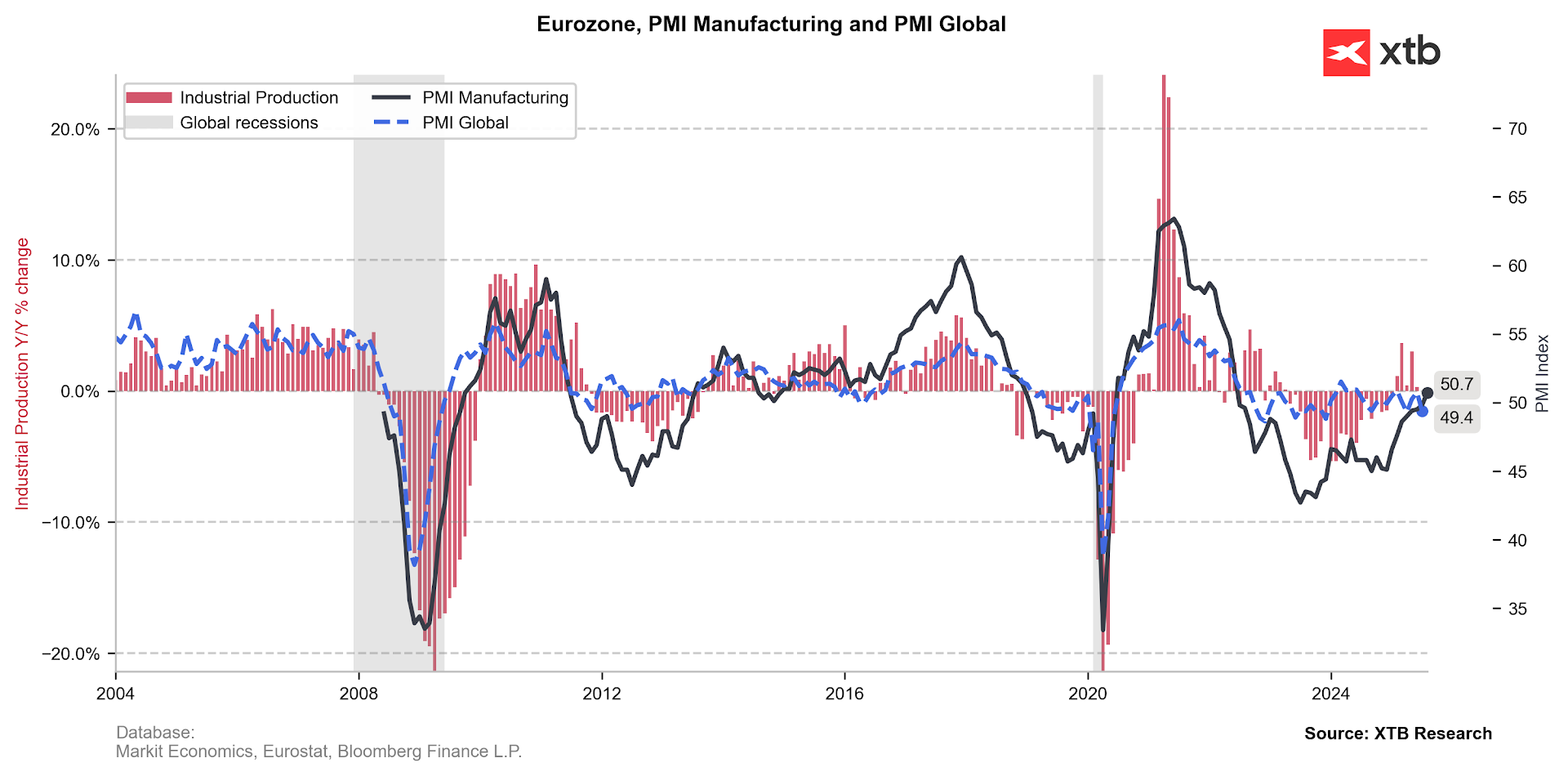

Today's release of manufacturing PMI data for the eurozone revealed stronger-than-expected results. While the figures for the largest economies were final readings, several key points are noteworthy:

-

Spain showed a significant improvement, with the index rising to 54.3, well above the expected 52.0 and the previous month's 51.9.

-

Italy returned to expansion territory, with the index at 50.4, surpassing both the forecast of 49.8 and the previous reading of 49.8.

-

France's final reading was stronger than the preliminary one, climbing above 50 to 50.4. This is a marked improvement from the preliminary 49.9 and July's 48.2.

-

Germany's data was slightly below the preliminary reading and remained below the expansion threshold. The final figure was 49.8, compared to the preliminary 49.9, though it still represents a gain from July's 49.1.

-

Overall, the final eurozone manufacturing PMI stood at 50.7, beating both the forecast and preliminary reading of 50.5. This is a notable rise from July's 49.8 and marks the highest reading since June 2022, reversing a downward trend. A key driver of this rebound is the recovery in new orders, which came in at 50.8 compared to 49.3 in July.

Beyond the eurozone, PMI readings were largely better than anticipated across the globe. Switzerland's data improved to 49.0, defying expectations of a significant decline, likely fueled by concerns over tariffs. During the Asian session, readings from Australia and smaller Chinese firms also exceeded forecasts. The only outlier was a slightly weaker-than-expected PMI from Japan.

Today's European data is providing momentum for the EUR/USD pair, which is being driven not only by dollar weakness but also by signs of a European recovery. The pair has already climbed past the 1.1720 level. Despite a sharp sell-off on Wall Street at the end of last week, European markets are showing signs of life this morning.

Daily summary - Government stays shut, Market declines, crypto recovers

Extended decline at the end of a week! 🚨

US OPEN: Market extends decline at the end of the week

BREAKING: University of Michigan sentiment declines! 📉