Flash PMI release for March were key releases scheduled for today's European session. As always, readings from France and Germany were the most closely watched ones. Highlights of the reports:

France

-

Manufacturing: 58.8 vs 56.5 expected (56.5 previous)

-

Services: 47.8 vs 45.5 expected (45.6 previous)

Germany

-

Manufacturing: 66.6 vs 60.8 expected (60.7 previous)

-

Services: 50.8 vs 46.2 expected (45.7 previous)

While the French reading continued to show the services sector still within a contraction territory, the situation changed in Germany. Services gauge jumped back above 50 pts in March, signalling that the sector began expanding. A point to note is that in each case - be it German or French, manufacturing or services - we have seen beats. Moreover, subindices showed an improving picture with French composite employment index rallying. It looks like economies have learned how to live with lockdowns and the latest set of restrictions does not seem to have much of an impact on the economic activity.

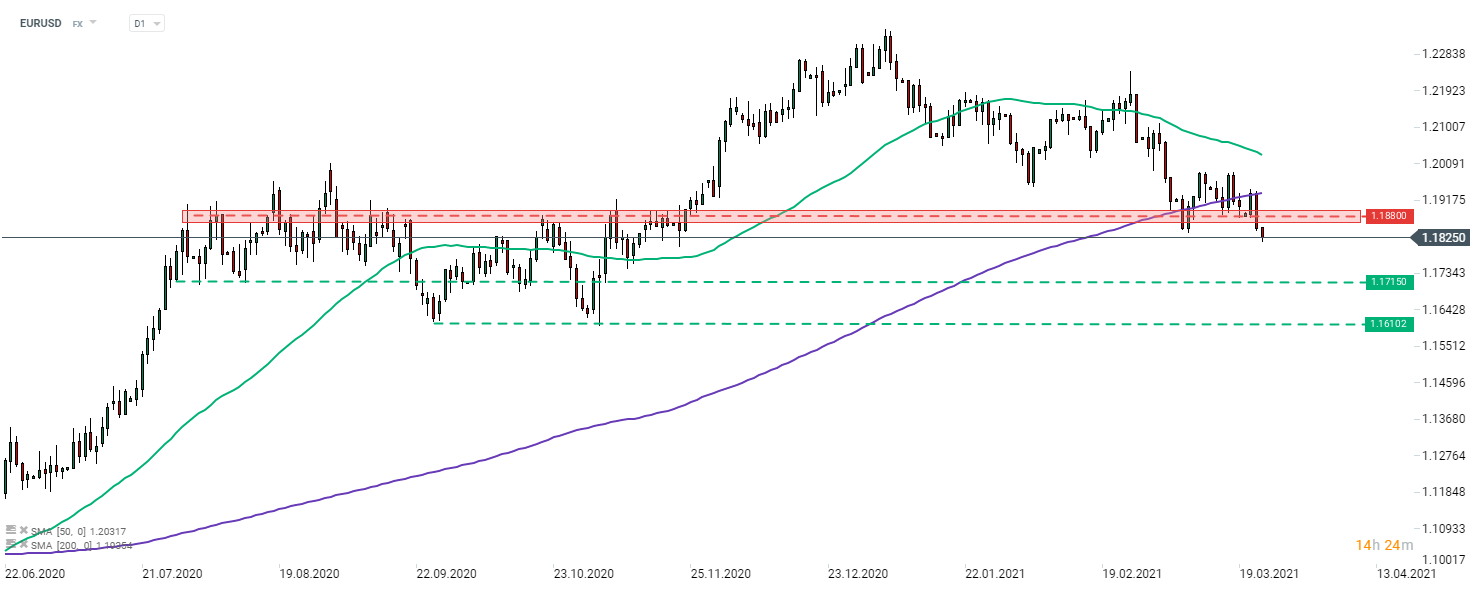

While EURUSD seesawed after French data was released, the main currency pair caught a bid after German report showed a massive manufacturing beat. The pair bounced off the daily lows and and attempted to climb back above 1.1830 at press time. A break back above the 1.1880 resistance zone could make an outlook more bullish. Source: xStation5

While EURUSD seesawed after French data was released, the main currency pair caught a bid after German report showed a massive manufacturing beat. The pair bounced off the daily lows and and attempted to climb back above 1.1830 at press time. A break back above the 1.1880 resistance zone could make an outlook more bullish. Source: xStation5

AUDUSD: Will the RBA be the next central bank to return to rate hikes?

Economic calendar: Fed decision – markets sharply scale back rate-cut expectations 🔎

Morning wrap (28.01.2026)

U.S. dollar sell-off 🚨 USDIDX slumps nearly 1%