07:00 AM BST, United Kingdom - Employment Data for July:

- Average Earnings ex Bonus: actual 4.8%; forecast 4.8%; previous 5.0%;

- Unemployment Rate: actual 4.7%; forecast 4.7%; previous 4.7%;

- Employment Change 3M/3M: actual 232K MoM; forecast 220K MoM; previous 238K MoM;

- Average Earnings Index +Bonus: actual 4.7%; forecast 4.7%; previous 4.6%;

07:00 AM BST, United Kingdom - Claimant Count Change for August:

- actual 17.4K; forecast 15.3K; previous -33.3K;

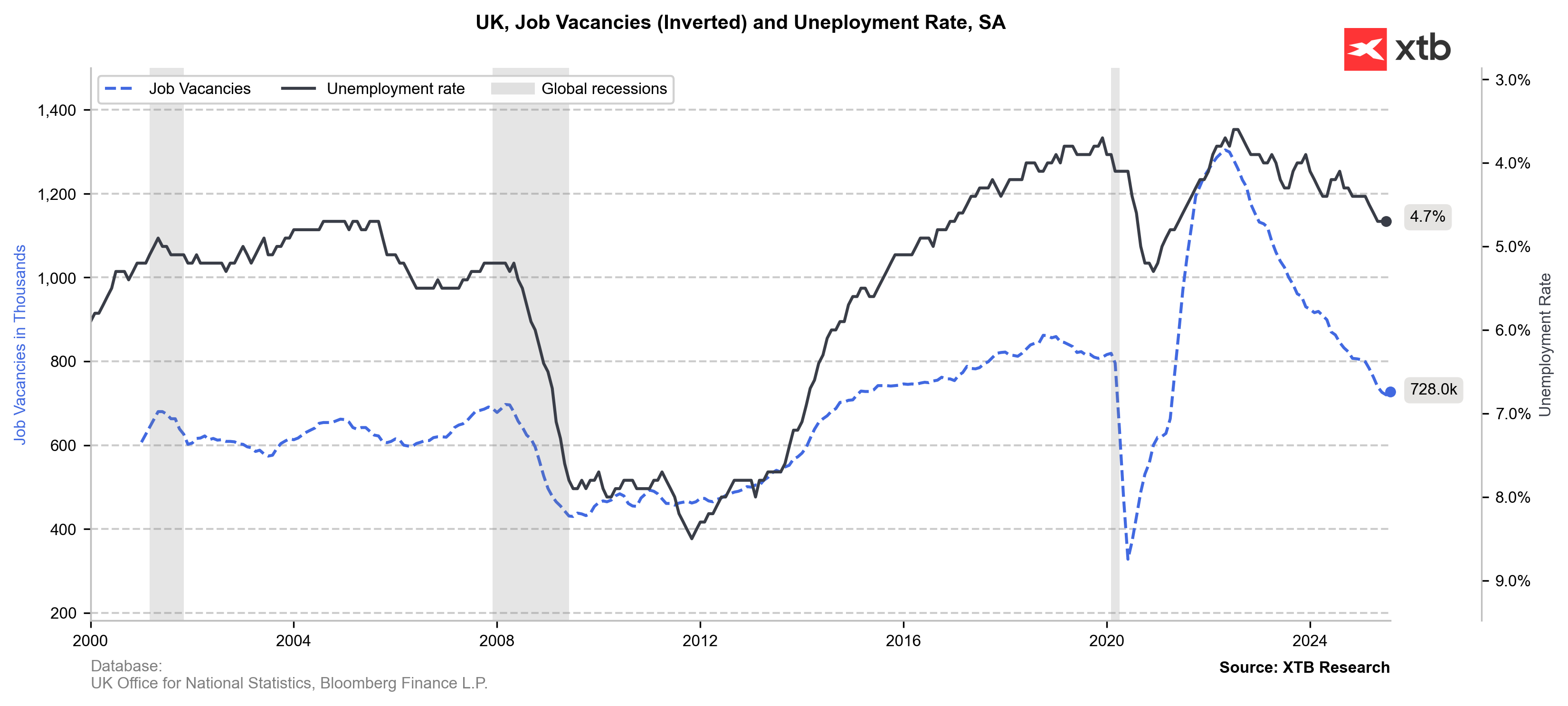

UK labour market signals softened: payrolled employees fell 125k y/y in May–July, and the early August estimate is down 127k y/y to 30.3m (provisional). The employment rate edged up to 75.2%, unemployment rose to 4.7%, and inactivity dipped to 21.1%. Vacancies fell for a 38th straight period to 728k; workforce jobs were 36.8m (-182k since March, +139k y/y), with public-sector jobs at 6.17m (+75k y/y). Pay growth stayed firm—regular +4.8% and total +4.7% y/y—implying real gains of +0.7%/+0.5% on CPIH (or +1.2%/+1.0% on CPI).

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report