- Crude oil inventories in the US decline by most sinve September 12

- Gasoline and distillate inventories also declined

- Crude oil inventories in the US decline by most sinve September 12

- Gasoline and distillate inventories also declined

Crude oil inventories: -0.961 mb (forecast: +2.181 mb; prior: 3.5 mb)

Gasoline inventories: -2.1 mb (forecast: -1.6 mb; prior: -0.27 mb)

Distillate inventories: -1.48 mb (forecast: -3.2 mb; prior: -4.5 mb)

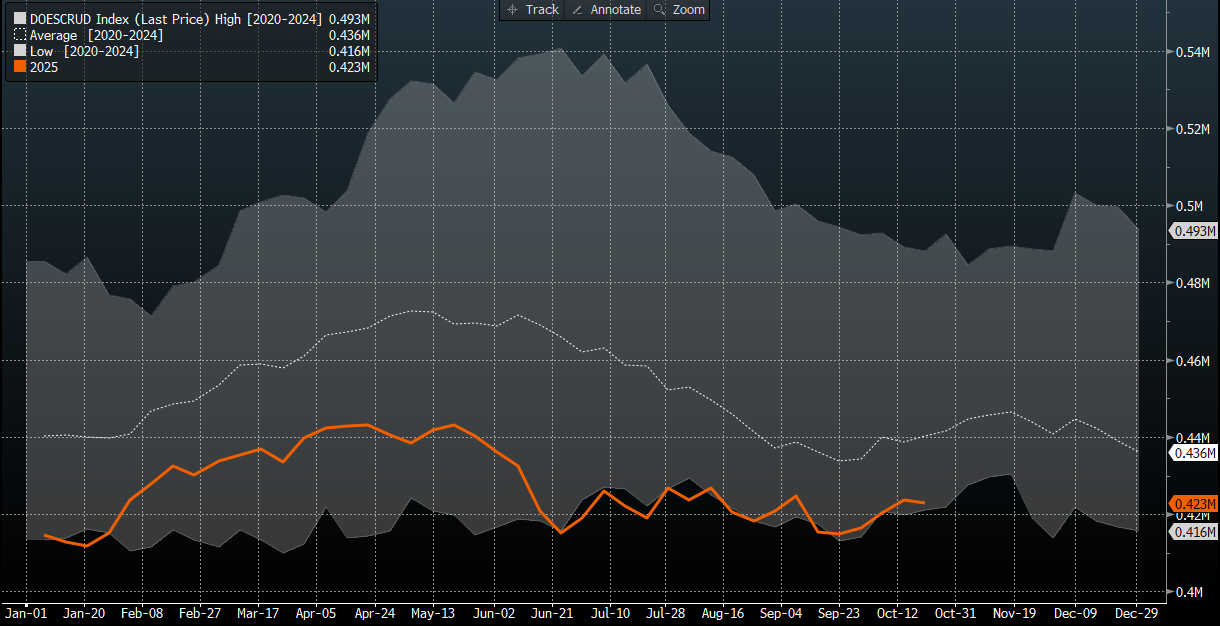

US oil and product inventories fell in the week ended October 17, following a significant increase in the previous week. Inventories are slighly up compared to the level from the last year. It is important to note that commercial stock decrease was almost completely offset by another injection to Strategic Petroleum Reserve of 820 kb. The price is a little changed after the reading. WTI is still below 59 USD per barrel for December contract. Data failed to change focus from trade talks and also information about oil export from Russia.

Crude inventories are still slightly above 5 year minimum which is also a level from the previous year. The situation seems to be interesting as the oversupply in the market is huge and inventories are rather flat in recent months. Source: Bloomberg Finance LP

🛢️WTI Crude Rises Over 2%

IBM Earnings Preview: Will grandfather of IT industry deliver expectations?

Teledyne Technologies – Strong results but shares fall over 5%

Texas Instruments tumbles down after earnings, what went wrong?