We have just received a mix of US data and the news is clearly bad:

- Initial claims 229k (expected 215k, previous 229k revised to 232k)

- Housing starts 1549k (expected 1701k, previous 1724k, revised to 1810k)

- Building permits 1695 (expected 1787k, previous 1823k)

- Philly Fed activity index -3.3 (expected 5.3, previous 2.6)

This shows clearly weakening economy even ahead of the major tightening from the Fed, contrasting the message from Chairman Powell that the US economy was well positioned to face significant tightening. While an immediate reaction to the data is minor, it compounds the challenge for the central bank and this challenge (that might result in a recession) is the main reason why the US500 is already 1100 of the 21 ATH.

EURUSD gains modestly after a weak data package from the US. So far May lows are holding but the trend remains negative.

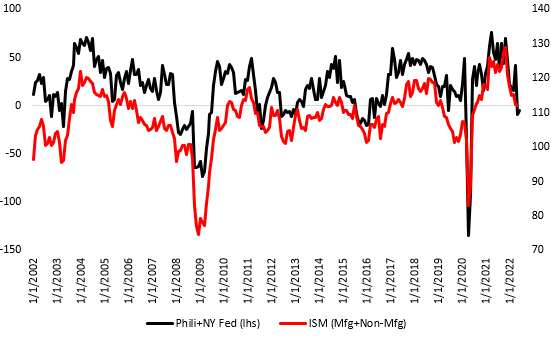

Not a rosy picture. Philly Fed + NY Fed indicators remain negative for the second straight month, heralding a slide in ISM into contraction territory. Source: Macrobond, XTB Research

Not a rosy picture. Philly Fed + NY Fed indicators remain negative for the second straight month, heralding a slide in ISM into contraction territory. Source: Macrobond, XTB Research

Daily summary: Sentiments on Wall Street stall at the end of the week🗽US Dollar gains

Fed's Bostic and Hammack comment the US monetary policy 🔍Divided Fed?

Scott Bessent sums up the US trade deal with China🗽What will change?

Fed members comment on US economy 🗽US dollar gains