US Conference Board Consumer Confidence index unexpectedly increased to 113.8 in October, from the previous month's 109.3 and compared to market expectations of 108.9. Further details of the publication showed that the Present Situation Index jumped to 147.4 from 143.4 and the Consumer Expectations Index edged higher to 91.3 from 86.6.

"Consumer confidence improved in October, reversing a three-month downward trend as concerns about the spread of the Delta variant eased," said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. "While short-term inflation concerns rose to a 13-year high, the impact on confidence was muted. The proportion of consumers planning to purchase homes, automobiles, and major appliances all increased in October-a sign that consumer spending will continue to support economic growth through the final months of 2021. Likewise, nearly half of respondents (47.6%) said they intend to take a vacation within the next six months-the highest level since February 2020, a reflection of the ongoing resurgence in consumers' willingness to travel and spend on in-person services."

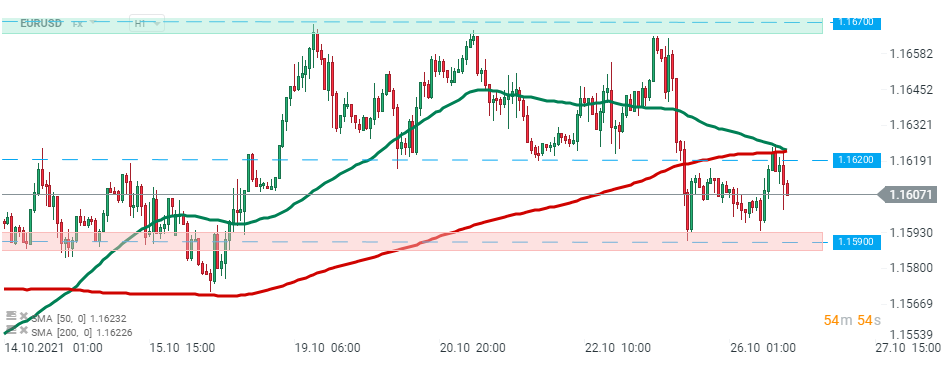

EURUSD bounced off the 1.1620 resistance which coincides withh 50 SMA (green line) and 200 SMA ( red line) and is heading towards next support level at 1.1590. Source:xStation5

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)