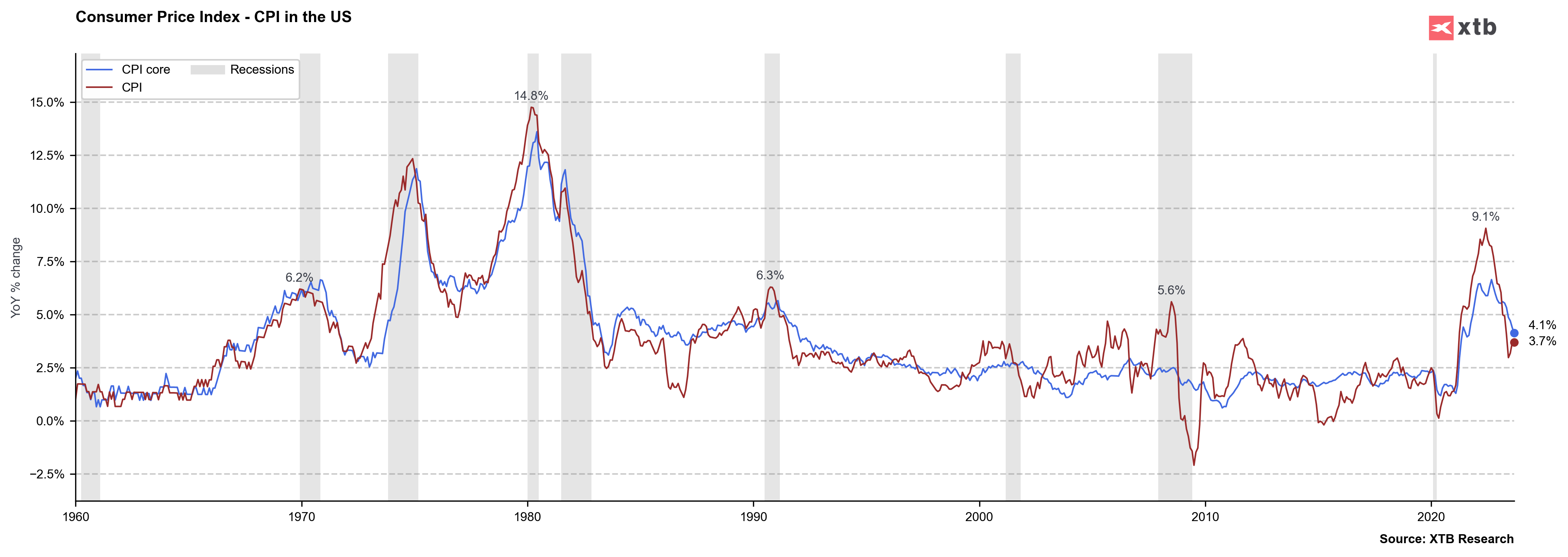

US CPI reading for September y/y: 3,7% vs 3,6% exp and 3,7% previously

- US CPI reading for September m/m: 0,4% vs 0,3% exp and 0,7% previously

US Core CPI reading for September y/y: 4,1% vs 4,1% exp and 4,3% previously

- US Core CPI reading for September m/m: 0,3% vs 0,3% exp and 0,3% previously

US Initial jobless claims: 209 k vs 210 k exp. and 207 previously

- US contiuned jobless claims: 1702 mln vs 1676 mln exp and 1664 mln previously

Slightly higher than expected US CPI reading may be a signal to Fed that's still to early to end the rate hike cycle and the situation will be safer if interest rates will increase at least once more time (maybe the sooner, the better until strong economy is a mandate to do that). At the same time 'negatively' surprise is very little and inflation cooled off strongly in US economy, what's more and important - the core reading is lower in line with expectations. US jobless claims number was slightly higher but the job market is still very tight (despite higher reading of continued jobless claims). USDIDX gains after the US inflation data and we can see sellers pressure on US100.

Source: xStation5

Source: xStation5

Source: XTB Research

Source: XTB Research

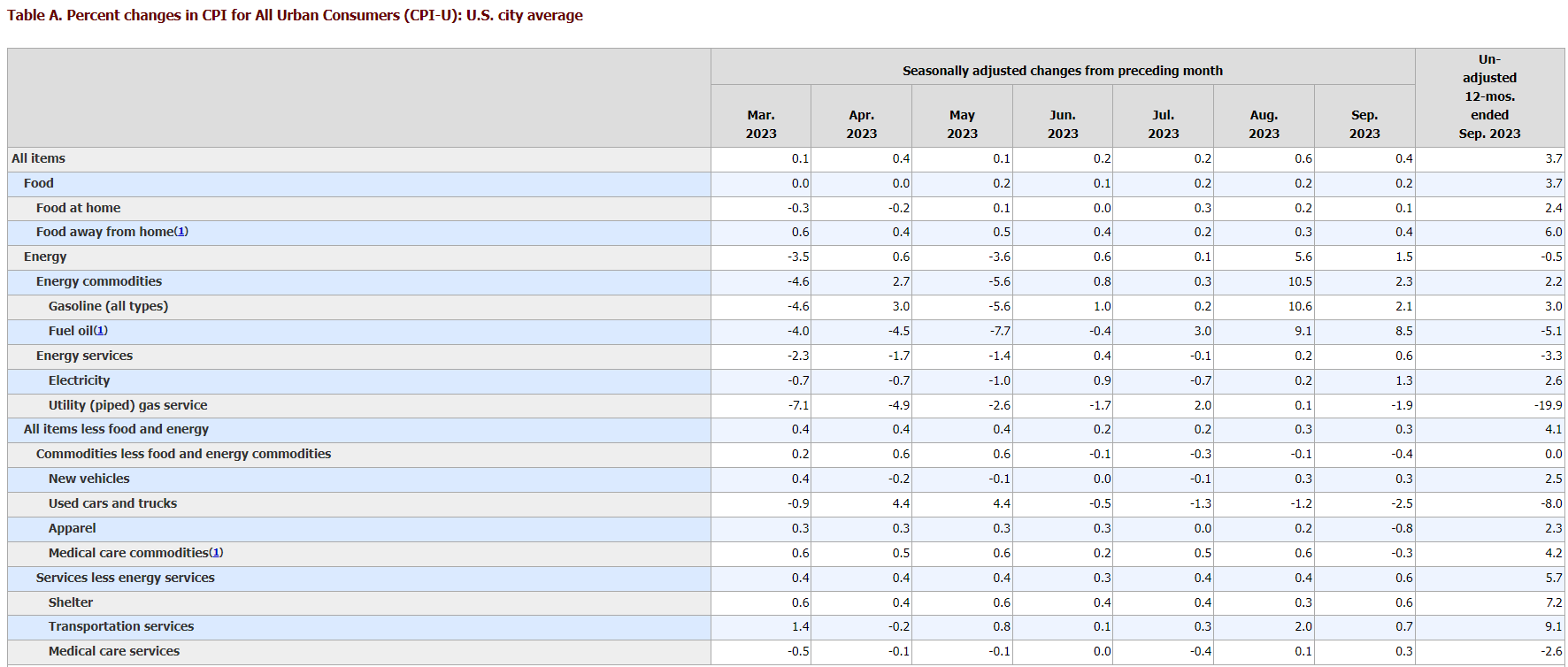

Higher services (especially transportation and shelter data may be a litte negative surprise for the markets. Source: BLS

Higher services (especially transportation and shelter data may be a litte negative surprise for the markets. Source: BLS

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)