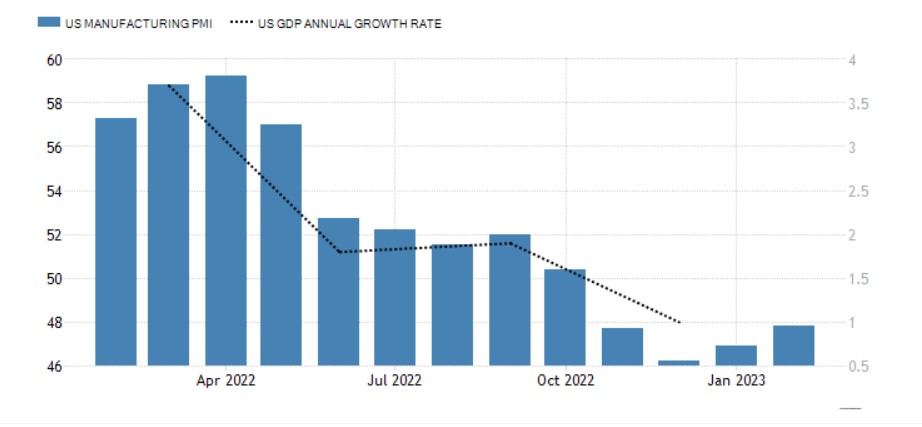

• The S&P Global US Manufacturing PMI rose to 47.8 in February from 46.9 in January, well above market forecasts of 47.3 flash estimates showed.

The reading pointed to a fourth consecutive month of falling factory activity although the smallest in the current sequence of decline. Production continued to fall amid weak client demand and new orders decreased sharply, with some companies noting that sufficient stocks at customers and high inflation dampened demand conditions. Meanwhile, lower buying activity also contributed towards an improvement in vendor performance. Suppliers’ delivery times were reduced to the greatest extent since May 2009 amid weak demand for inputs and fewer logistics issues. Employment rose at the fastest pace since last September and firms reduced their backlogs of work solidly. Input prices softened although selling prices rose the most in three months. Finally, the level of business confidence was broadly in line with that seen in January.

• The S&P Global US Services PMI jumped to 50.5 in January from 46.8 in the previous month, also above analysts' estimates of 47.2, a preliminary estimate showed.

Quite a positive surprise. Services are back above expansion territory, which shows that the economy may not be slowing down at all. This is also good news for GDP from the perspective of Q1.

US GDP may rebound in the first quarter. Source: Trading Economics

EURUSD deepened decline after PMI release. The pair broke below major support at 1.0660. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)