- GDP QoQ Final Actual 4.9% (Forecast 5.2%, Previous 5.2%)

- GDP Price Index Actual 3.6% (Forecast 3.6%, Previous 3.6%)

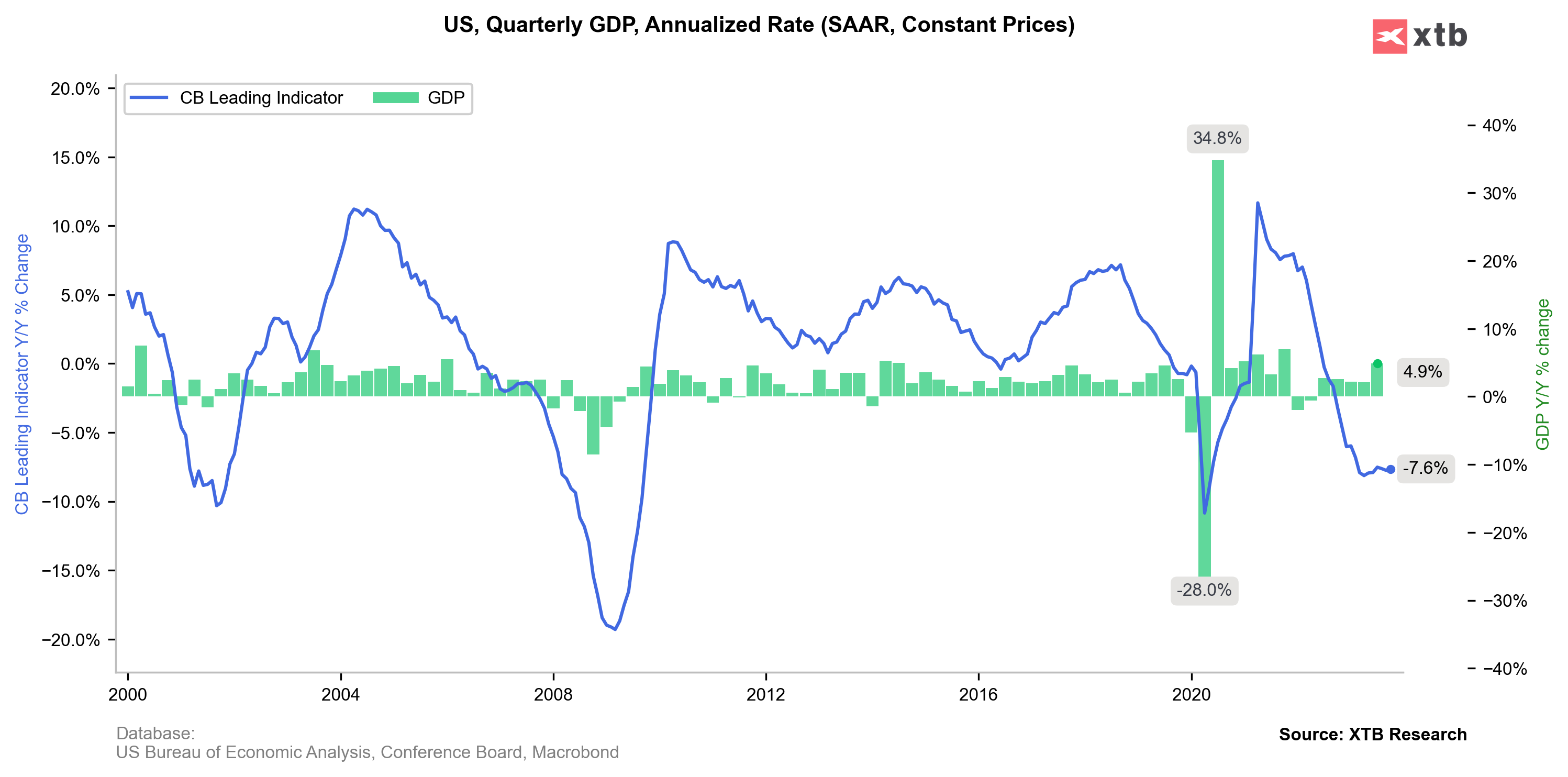

In the third quarter of 2023, the US real gross domestic product (GDP) increased by 4.9%, a slight downward revision from the 5.2% second estimate, primarily due to reduced consumer spending and imports. This growth, up from 2.1% in the previous quarter, was driven by increases in consumer spending, private inventory investment, exports, and government spending, among others. Current-dollar GDP rose to $27.61 trillion, with the price index for gross domestic purchases increasing by 2.9%. Personal income saw an increase, with disposable personal income and personal saving also rising. Real gross domestic income (GDI) grew by 1.5%, and corporate profits saw a significant increase, with adjustments in various sectors. The revisions reflect more complete source data, indicating a robust but slightly moderated economic expansion compared to earlier estimates.

EURUSD gains after the publication. Investors are pricing in more chances for faster interest rate cuts after a weaker GDP report.

Source: xStation 5

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀