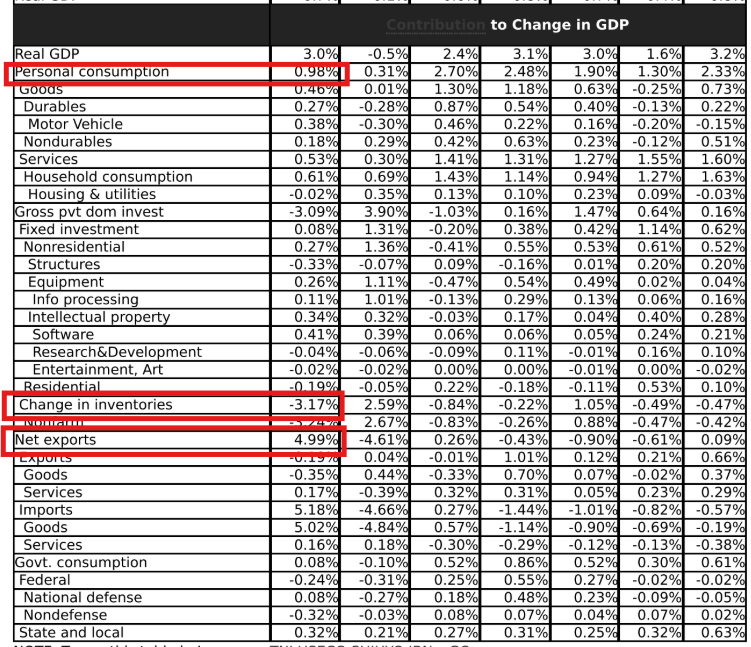

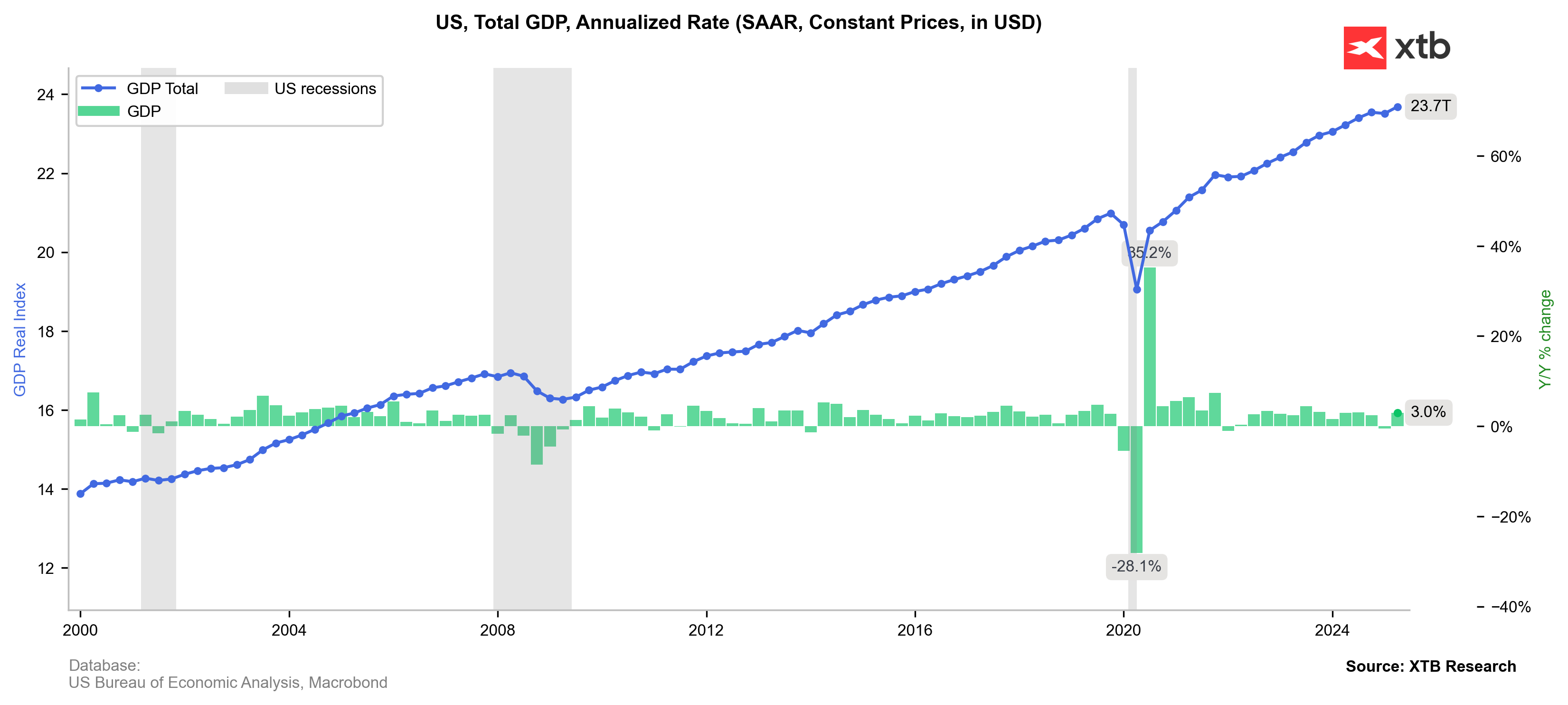

- Annualized growth for Q2 (first reading): 3.0% (expected: 2.4%; previous: -0.5%)

Core personal consumption expenditure (PCE) index (quarterly): 2.5% (expected: 2.4%; previous: 3.5%)

Consumer spending price index: 2.1% (previous: 3.7%)

GDP deflator: 2.0 (expected: 2.2%; previous: 3.8%)

Consumption: 1.4% (expected: 1.5%; previous: 0.5%)

As expected, the largest contribution comes from net exports. This amounted to almost 5%, significantly higher than the forecasts, which indicated slightly over 4%. As expected, there was a marked decline in inventories and solid consumption, albeit slightly slower than the average for recent years: However, it should be noted that the Q1 and Q2 readings are heavily distorted by trade and inventory issues. If these factors were eliminated, growth would not have been so strong.

Daily Summary: Wall Street ends the week with a calm gain 🗽 Cryptocurrencies slide

NATGAS surges 5% reaching 3-year high 🔎

Bitcoin loses 3% 📉Technical bearish flag pattern?

3 markets to watch next week (05.12.2025)