US PCE price index y/y: 4,2% vs 4,1% exp. and 5,0% previously

US PCE price index m/m: 0,1% vs 0,1% exp and 0,3% previously

US Core PCE y/y: 4,6% vs 4,58% exp and 4,6% previously

US Core PCE m/m: 0,3% vs 0,3% exp and 0,3% previously

US Consumer spending data: 0% vs -0,1% exp and 0,2% previously

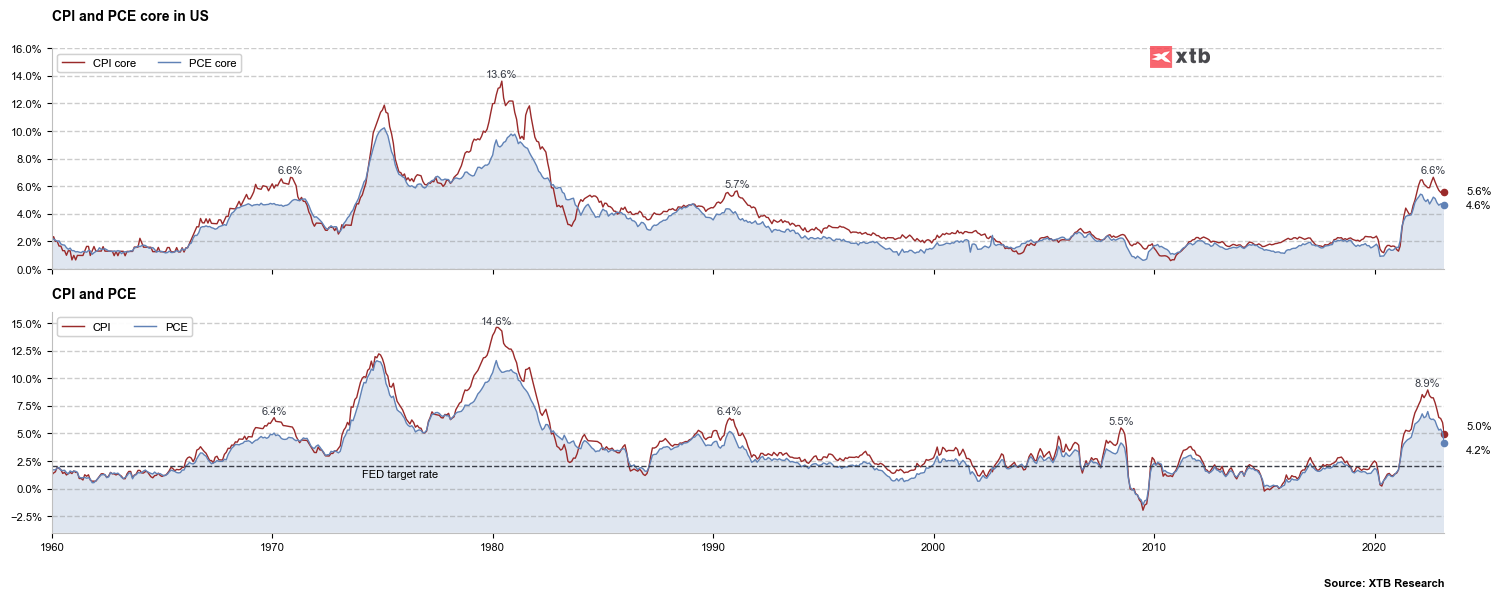

The data are mostly hawkish, because Fed may read it as higher inflation regime warning. The PCE measure is key for Federal Reserve policmakers. Americans income is higher but consumption is slower indicating that inflation put some pressure on US households.

Core PCE inflation is falling slower than the analyst consensus expected. The overall trend against CPI readings is of course still pointed downward. However, the loss of downfall momentum may herald that price pressures are becoming entrenched at levels that are too high. In that case, the Fed would have a much more difficult job to do. Source: XTB

Core PCE inflation is falling slower than the analyst consensus expected. The overall trend against CPI readings is of course still pointed downward. However, the loss of downfall momentum may herald that price pressures are becoming entrenched at levels that are too high. In that case, the Fed would have a much more difficult job to do. Source: XTB

The first reaction of US100 on PCE data is mixed. Source: xStation5

The first reaction of US100 on PCE data is mixed. Source: xStation5

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)