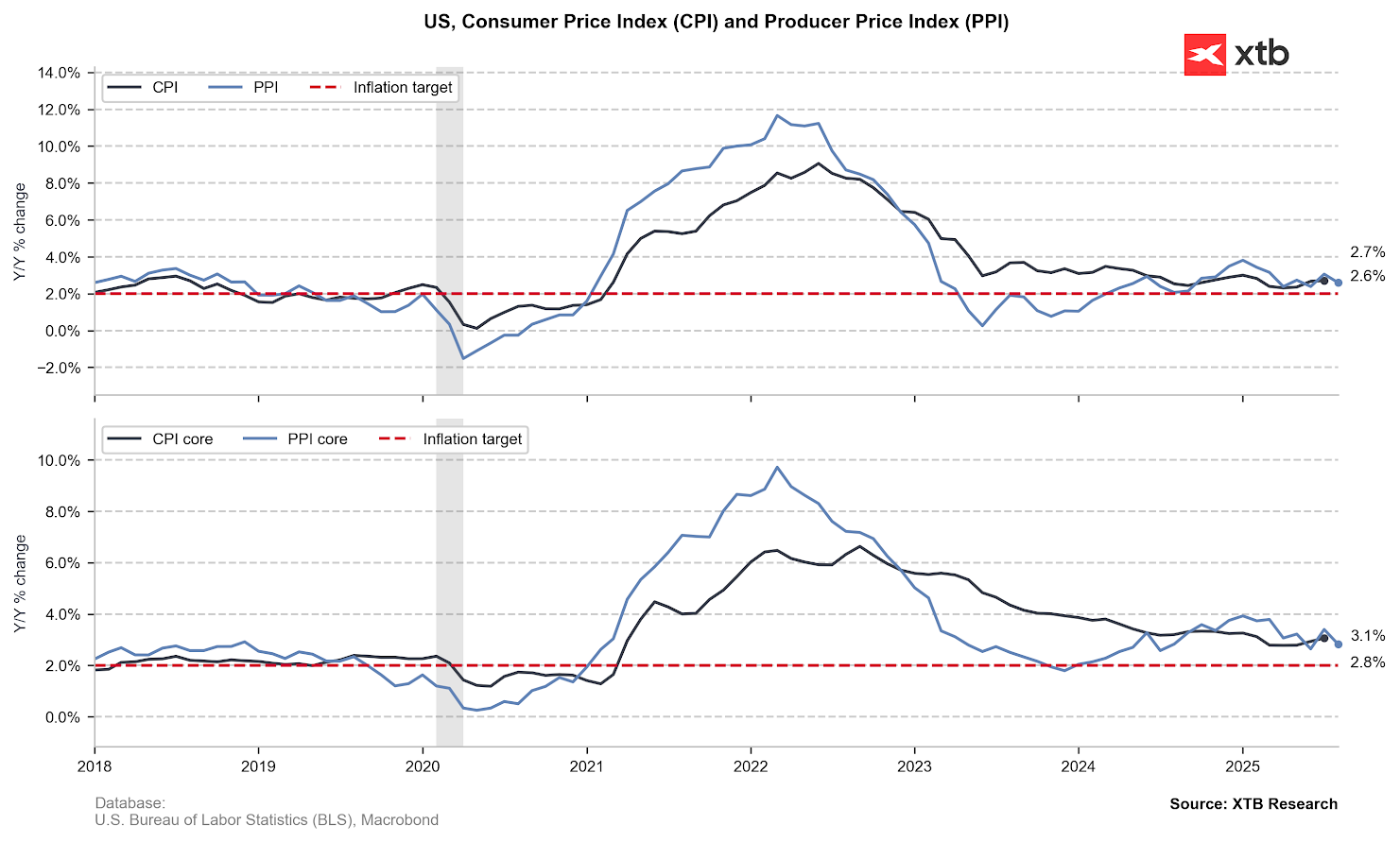

August US PPI YoY: 2.6% (Forecast 3.3%, Previous 3.3%, Revised 3.1%)

- US PPI MoM Actual -0.1% (Forecast 0.3%, Previous 0.9%, Revised 0.7%)

August US Core PPI YoY: 2.8% (Forecast 3.5%, Previous 3.7%, Revised 3.4%)

- US Core PPI MoM: -0.1% (Forecast 0.3%, Previous 0.9%, Revised 0.7%)

Short-term US interest-rate futures tick up after PPI inflation data, amid traders adding bets on a September Fed rate cut. The reading signals that price pressure across the manufacturing sector (but not only) eases, rising odds for a favourable for Wall Street and key for investors and analysts CPI data tomorrow.

Source:XTB Research, Bloomberg Finance L.P, BLS, Macrobond

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!