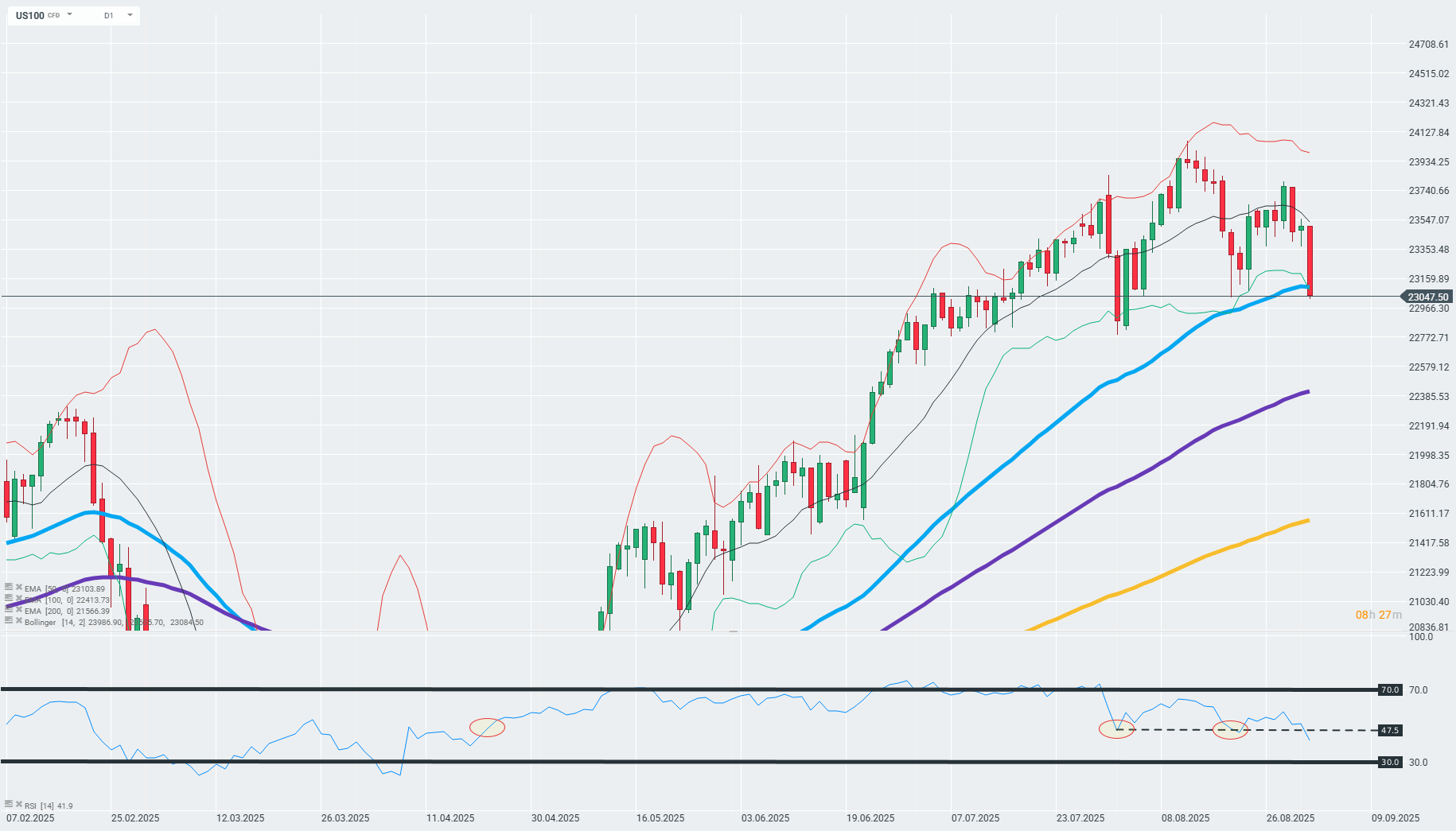

The decline in stock market indices is gaining momentum today. The US100 is down nearly 2% and testing the 50-day EMA, with selling pressure clearly visible in the technology sector. An equally strong technical signal has appeared on the German market, where the DE40 is breaking below the 100-day EMA, which may herald a continuation of the correction in the medium term.

The current wave of sell-offs is part of a global risk aversion driven by expectations regarding macroeconomic data and doubts about monetary policy. Investors are currently limiting their exposure to major indices, fearing increased volatility in the coming sessions. The key to current sentiment will be the nearest technical support levels. A clear break below these levels could intensify selling pressure on global markets.

The downward momentum according to the 14-day RSI has not been this bearish on the US100 since April this year. Source: xStation

The German DE40 breaks the 100-day EMA for the first time since the wave of panic caused by tariff tensions in April. Source: xStation

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉