Despite ongoing correction on Wall Street, FactSet Research data signals still strong earnings season across the US public companies. Here is the highlight actual as of November 7 (after Big Tech ex-Nvidia earnings reports).

-

Strong Q3 reporting season: With 91% of S&P 500 companies already out with results, 82% beat earnings expectations, while 77% topped revenue forecasts — a broadly positive quarter.

-

Earnings growth gaining momentum: S&P 500 profits are on track to grow 13.1% year over year in Q3. If confirmed, this would mark the fourth straight quarter of double-digit earnings growth, showing solid corporate momentum.

-

Upward revisions across sectors: At the start of the quarter (September 30), earnings growth was estimated at 7.9%. Companies have significantly outperformed since then, lifting the blended growth rate, with 10 sectors now reporting higher earnings thanks to positive EPS surprises.

-

Guidance remains mixed: Looking ahead to Q4, 42 companies have issued negative EPS guidance, while 31 companies provided positive guidance, suggesting a cautious but not pessimistic outlook.

-

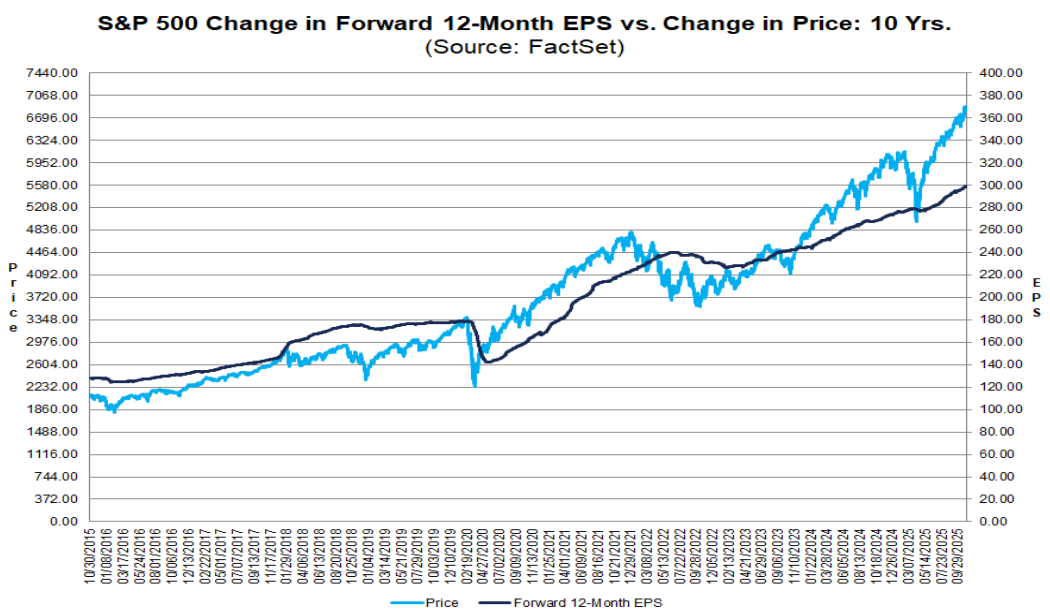

Valuations above long-term norms: The S&P 500 trades at a forward P/E of 22.7, which is above the 5-year average (20.0) and above the 10-year average (18.6) — signaling elevated valuations relative to historical levels.

Source: FactSet

82% of Companies Beat EPS Expectations & 77% Beat Expected Revenue

-

Q3 earnings season is delivering strong results, comfortably beating analyst expectations. A larger-than-usual share of S&P 500 companies is surprising to the upside, and the index is now showing higher earnings than both last week’s levels and the end-of-quarter estimates.

-

With 91% of S&P 500 companies having already reported, 82% beat EPS expectations — well above the 5-year average (78%) and 10-year average (75%). If this number holds, it would match the best beat rate since Q3 2021.

-

The magnitude of earnings surprises is also healthy: on aggregate, profits are coming in 7% above expectations, matching the 10-year average (and just slightly below the 5-year trend of 8.4%).

-

The S&P 500 is now on track for 13.1% year-over-year earnings growth in Q3, marking the fourth consecutive quarter of double-digit profit expansion. This figure has climbed steadily from 7.9% at the end of Q3 and 10.7% just one week ago, boosted by stronger-than-expected results.

-

Over the past week, companies in the Industrials, Financials, and Health Care sectors delivered the most meaningful earnings surprises, pushing the overall earnings growth rate higher.

-

Since September 30, the biggest positive contributions to earnings growth have come from Financials, Information Technology, and Consumer Discretionary companies. Weak results from Communication Services partially offset those gains.

-

Revenue performance is also robust: companies are beating top-line estimates at rates well above historical norms, with many reporting meaningful year-over-year growth.

Strong Earnings Trend Set To Persist?

-

If the S&P 500 ultimately delivers 13.1% earnings growth for Q3, it would mark the fourth straight quarter of double-digit year-over-year profit growth and the ninth consecutive quarter of positive earnings growth overall — a sign of sustained corporate strength.

-

Eight of eleven sectors are showing year-over-year earnings growth, with the strongest contributions coming from Information Technology, Financials, Utilities, Materials, and Industrials.

Meanwhile, three sectors are posting declines, led by Communication Services. -

On the revenue side, 77% of S&P 500 companies have beaten expectations. It's well above both the 5-year (70%) and 10-year (66%) averages. Aggregate revenues are coming in 2.1% above estimates, matching the 5-year norm and exceeding the 10-year average of 1.4%.

-

Over the past week, stronger-than-expected revenue results across several industries — most notably Financials and Consumer Staples — lifted the index’s overall revenue growth rate.

-

Since the end of Q3 (September 30), the biggest contributors to rising revenue growth have been companies in Health Care, Financials, and Consumer Discretionary, reflecting broad-based momentum across cyclical and defensive groups.

Revenue Growth Is Rising

-

The S&P 500’s blended revenue growth rate for Q3 has risen to 8.3%, up from 7.9% last week and 6.3% at the end of Q3. If 8.3% holds, it would be the strongest revenue growth since Q3 2022 (11%) and mark the 20th straight quarter of year-over-year revenue expansion.

-

All eleven sectors are posting revenue growth compared to a year earlier — with Information Technology, Health Care, and Communication Services leading the charge, showing broad strength across the index.

-

Looking ahead, analysts expect earnings growth of 7.5% in Q4 2025, 11.8% in Q1 2026, and 12.7% in Q2 2026. For full-year 2025, consensus calls for 11.6% earnings growth.

-

The S&P 500 currently trades at a forward P/E of 22.7, above both the 5-year (20.0) and 10-year (18.6) averages, though just slightly below the 22.8 level recorded at the end of Q3.

EPS Beats Remain Strong

-

With 91% of the index having reported Q3 numbers, 82% delivered EPS above expectations, 3% met estimates, and 15% missed.

-

The 82% beat rate is above the 1-year (77%), 5-year (78%), and 10-year (75%) averages.

-

If this figure stands, it would match the highest beat rate since Q3 2021.

-

Sector leaders in EPS beats include:

-

Health Care – 93%

-

Consumer Staples – 93%

-

Information Technology – 92%

-

Financials – 89%

The weakest sector is Communication Services – 62%.

-

Earnings Surprise Magnitude

-

On average, companies are reporting earnings 7.0% above estimates — in line with the 10-year average, though slightly below the 1-year and 5-year averages.

-

The Industrials sector shows the biggest upside surprise, with earnings coming in 15.6% above expectations. Notable contributors include:

-

Southwest Airlines ($0.11 vs. –$0.04)

-

Uber Technologies ($3.11 vs. $0.69)

-

UPS ($1.74 vs. $1.29)

-

US500 (D1 chart)

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war