The US NFP report for August was released at 1:30 pm BST today. This is the final piece of key data from the US labor market ahead of the FOMC meeting later this month and was watched closely. Market expected non-farm payrolls to increase less than in July while the unemployment rate was expected to stay unchanged at 3.5%. Private ADP report released earlier this week suggested a 177k increase in US employment.

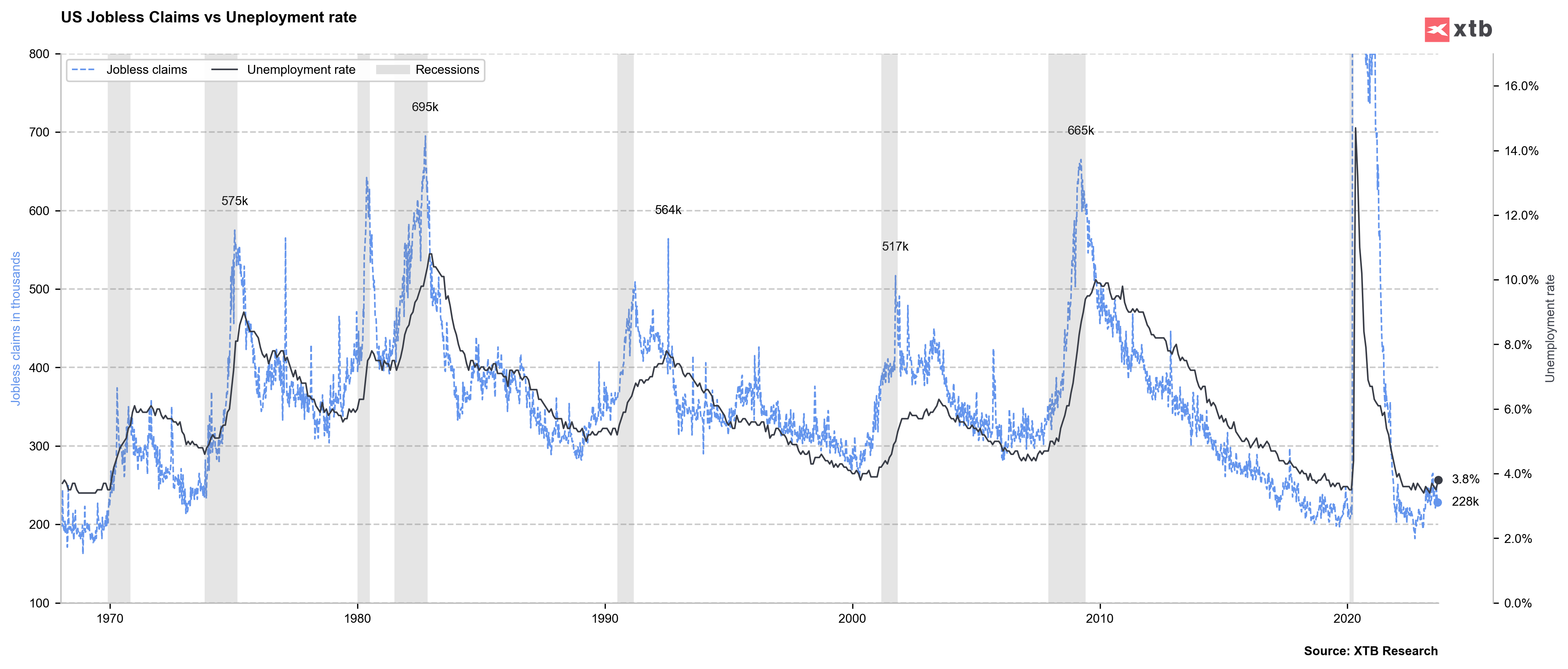

Actual report showed a small beat in non-farm as well as private payrolls. Wage growth data came in a touch lower than expected at 4.3% YoY. However, the biggest surprise came from unemployment rate which unexpectedly surged from 3.5 to 3.8% in August!

US, NFP report for August:

- Non-farm payrolls: 187k vs 170k expected (187k previously)

- Private payrolls: 179k vs 150k expected (172k previously)

- Unemployment rate: 3.8% vs 3.5% expected (3.5% previously)

- Wage growth: 4.3% YoY vs 4.4% YoY expected (4.4% YoY previously)

USD dollar dropped in response to data as surge in unemployment rate added to concerns coming from JOLTS or Challenger data and boosts likelihood of no hike at September meeting. However, it should be noted that FOMC expected pick-up in unemployment rate by the end of the year.

EURUSD surged following NFP data and tested 50-hour moving average (green line). Source: xStation5

EURUSD surged following NFP data and tested 50-hour moving average (green line). Source: xStation5

Economic calendar: US ISM manufacturing report 📈

Morning wrap (05.01.2026)

BREAKING: US December manufacturing PMI holds at 51.8; eases from 52.2 in November📌

BREAKING: S&P Manufacturing PMI data from the UK weaker than expected