01:30 PM BST, United States - Inflation Data for August:

- CPI: actual 0.4% MoM; forecast 0.3% MoM; previous 0.2% MoM;

- CPI: actual 2.9% YoY; forecast 2.9% YoY; previous 2.7% YoY;

- Core CPI: actual 0.3% MoM; forecast 0.3% MoM; previous 0.3% MoM;

- Core CPI: actual 3.1% YoY; forecast 3.1% YoY; previous 3.1% YoY;

EURUSD is gaining after the release, even though the market had partly expected below-consensus data following yesterday’s PPI surprise. The figures are in line with expectations, and a rate cut by the Fed next week now seems all but certain. However, we should not expect a move larger than 25 bps.

01:30 PM BST, United States - Employment Data for August:

-

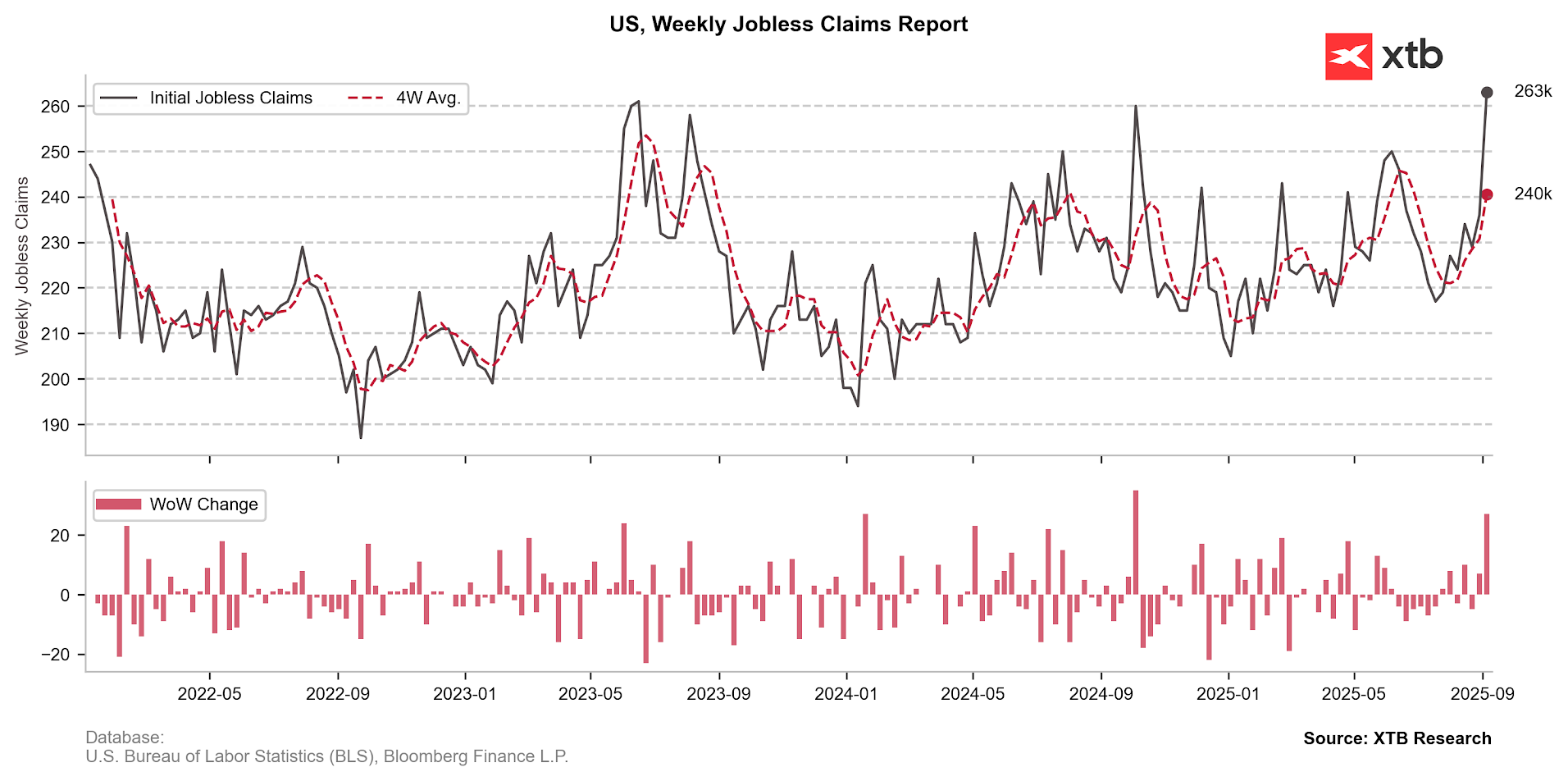

Initial Jobless Claims: actual 263K; forecast 235K; previous 236K;

The reaction in EURUSD is driven more by the sharp rise in jobless claims, which is the highest reading since October 2021. Combined with weaker NFP and ADP data, this picture sends a clear signal to the Fed to focus on the second leg of its dual mandate—the unemployment side. The CPI figures were in line with expectations and, for now, should not be a major cause for concern for Fed policymakers.

Now, traders fully price in three fed rate cuts by end-2025.

Economic Calendar: U.S. PCE Reading in the Spotlight!

Morning Wrap: Russian Oil with a 30-Day Purchase Permit

Daily summary: Stocks in Europe and US return to declines; Brent above $100 again ❗

BREAKING: NATGAS ticks higher after EIA data release 💡