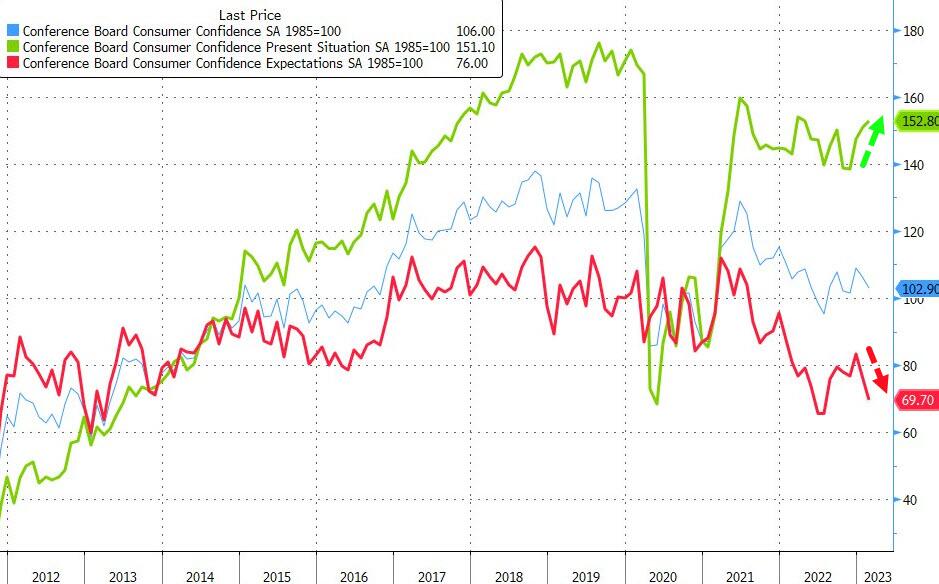

US Conference Board Consumer Confidence index decreased to 102.9 in February, from the previous month's 107.1 and wel below market expectations of 108.5.

-

Present situation index 151.1 vs 150.9 prior

-

Expectations index 69.7 vs 77.8 prior (revised to 76.0)

-

1 year inflation 6.3% vs 6.8% prior (revised to 6.7%)

-

Jobs hard-to-get 10.5 vs 11.3 prior (revised to 11.1)

-

13.4% of consumers expect their incomes to increase, down from 17.4% last month

“Consumer confidence declined again in February. The decrease reflected large drops in confidence for households aged 35 to 54 and for households earning $35,000 or more,” said Ataman Ozyildirim, Senior Director, Economics at The Conference Board. “While consumers’ view of current business conditions worsened in February, the Present Situation Index still ticked up slightly based on a more favorable view of the availability of jobs."

Todays' consumer confidence data eases expectations that the FED will need to raise rates to 6.0%, which supports US equities and weighs on the dollar.

The actual print came in well below expectations. Source: Bloomberg via ZeroHedge

Divergence between University of Michgans sentiment index and Conference Board consumer confidence index is still wide. Source: Bloomberg via ZeroHedge

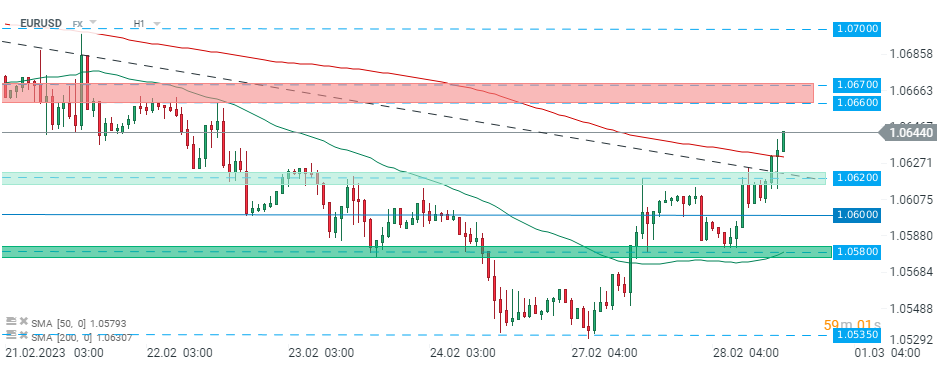

EURUSD is trading higher today and fresh data provided more fuel for bulls. The main currency pair is moving towards resistance zone in the 1.0660 area. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report