Brent and WTI crude both fell over 2.0% and deepened recent declines as a bigger-than-expected draw in US crude inventories failed to recover optimism to bulls. Sell-off intensified further even despite the fact that the EU proposed further economic measures against the Russian energy and mining sector, including a ban on new mining investments. OIL broke below the key support zone around $88.20 which is marked with 78.6% Fibonacci retracement of the upward wave launched in December 2021. If current sentiment prevails, the downward move may accelerate towards the lower limit of the descending channel or even support zone at $66.00.

OIL, D1 interval. Source: xStation5

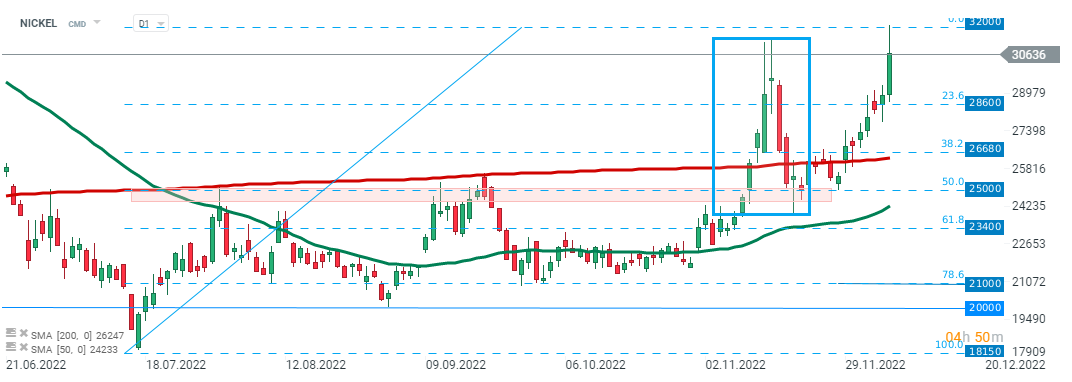

The price of NICKEL, of which Russia is one of the main producers, briefly jumped to 32,000, a level not seen since the end of April 2022. Source: xStation5

BREAKING: Oil prices plummet amid rumors of further OPEC production increases 🚨

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause