Summary:

-

Canadian inflation beats forecasts. CPI Y/Y: 2.4% vs 2.2% exp

-

Core measures unchanged and core retail sales miss

-

USDCAD reverses initial fall to rally to the highs of the day

The last major economic data of the week has caused some fairly sharp moves in the Canadian dollar, which initially surged higher but has since come back under pressure. The reason for the initial rally was a better than expected read in headline inflation, with the CPI for October coming in at 2.4% Y/Y against median estimates of a 2.2% gain. The prior reading was unchanged at 2.2%.

USDCAD dropped sharply before reversing higher following the release. The market fell by around 50 pips presumably on the headline beat in inflation before recovering as traders digested the unchanged core measures and the lower than forecast core retail sales. Source: xStation

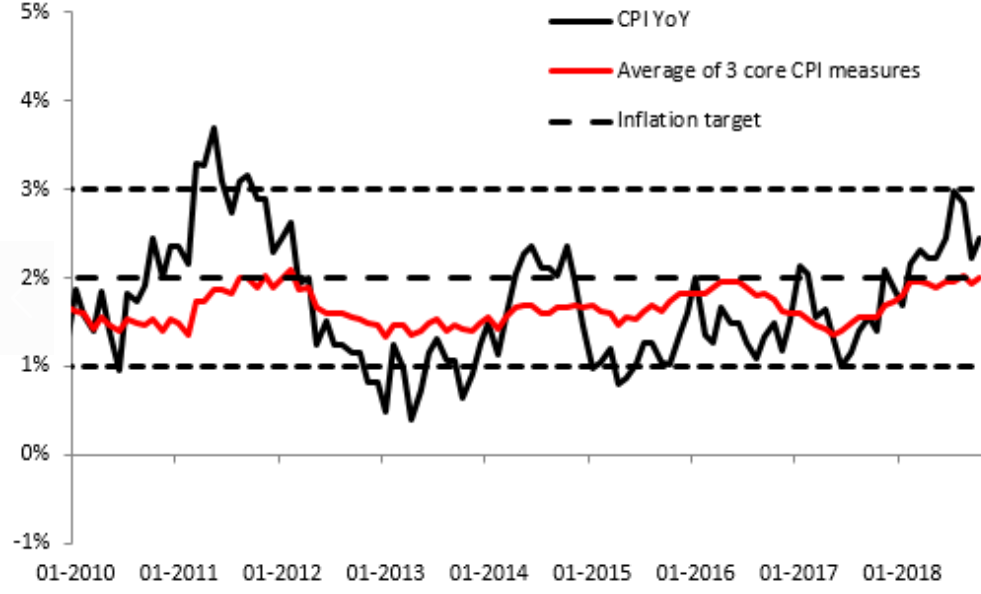

While this number often attracts the immediate attention, the 3 associated core measures are believed to matter more for the BOC and on this front there was no change. The core common remained at 1.9%, core median 2.0% and core trimmed 2.1%,with all the aforementioned listed in Y/Y terms and this gives a different impression that price pressures aren’t on the rise.

Despite a higher than expected headline reading the average of the 3 core measures remains in the middle of the BOC’s 1-3% inflation target. Source: xStation

At the same time as the inflation data dropped the most recent look at consumer spending was also released. There was a little bit of softness on the whole here despite the retail sales for September rising by 0.2% M/M vs 0.0% expected. The reason for the disappointment comes in the core reading for the corresponding period which rose by only 0.1% compared to 0.3% forecast. The prior reading was unrevised at -0.4%.

A longer term look at USDCAD reveals that price is still in a rising channel dating back to the end of September. The market recent respected the lower bound and today’s low around 1.3180 could be seen as important support. As for resistance the region from 1.3320-1.3385 has stopped rallies in their tracks previously and this is an area to keep an eye on should price advance once more.

USDCAD has respected the rising trendline from the bottom of the channel once more today and if this rally can continue then a retest of the longer term resistance from 1.3320-1.3285 could occur. Source: xStation

USDCAD has respected the rising trendline from the bottom of the channel once more today and if this rally can continue then a retest of the longer term resistance from 1.3320-1.3285 could occur. Source: xStation