Cameco (CCJ.US) stock fell 15.0% after the Canadian uranium producer joined forces with power plant operator Brookfield Renewable Partners in order to acquire nuclear power equipment maker Westinghouse Electric in a deal worth $ 7.88 billion, including debt. The deal, which is expected to close in the second half of 2023, comes amid growing interest in nuclear power due to the energy crisis in Europe and high oil and gas prices.

“Bringing together Cameco’s expertise in the nuclear industry with Brookfield Renewable’s expertise in clean energy positions nuclear power at the heart of the energy transition and creates a powerful platform for strategic growth across the nuclear sector,” the companies said in a statement.

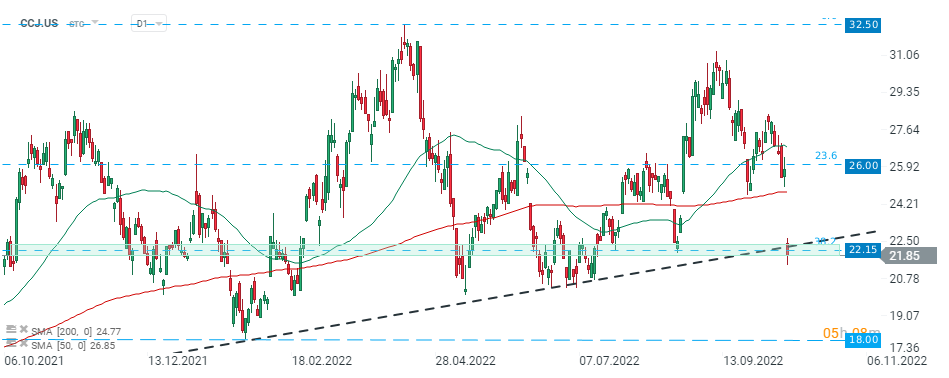

Cameco (CCJ.US) stock launched today's session with a massive bearish price gap and later broke below key support at $22.15, which coincides with upward trendline and 38.2% Fibonacci retracement of the upward wave launched at the beginning of pandemic. If current sentiment prevails, downward move may accelerate towards support at $18.00 where lows from January 2022 are located. Source: xStation5

Cameco (CCJ.US) stock launched today's session with a massive bearish price gap and later broke below key support at $22.15, which coincides with upward trendline and 38.2% Fibonacci retracement of the upward wave launched at the beginning of pandemic. If current sentiment prevails, downward move may accelerate towards support at $18.00 where lows from January 2022 are located. Source: xStation5

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈