Tesla (TSLA.US) stock rose more than 1% as the electric car maker benefited from higher Bitcoin prices as the company still has a hefty holding of the most popular digital asset. However, financial services firm Canaccord Genuity pointed out that potential delays regarding Tesla's battery development have lowered expectations regarding stock future performance. Tesla started deliveries of its new Model S Plaid last week, but withdrew a more expensive version. In a note to clients, Canaccord analyst Jed Dorsheimer praised the Plaid model but said the failed upgraded version could signal struggles for Tesla's battery business therefore reduced his price target on the stock from $ 974 to $ 812 per share.

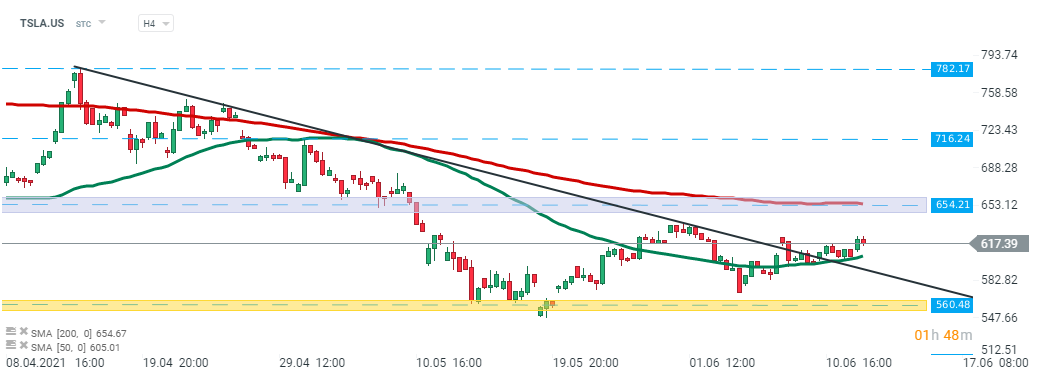

Tesla (TSLA.US) stock managed to break above the downward trendline last week. Today the price bounced off the 50 SMA ( green line). If buyers manage to uphold momentum then upward move may accelerate towards local resistance at $654.21 which is strengthened by 200 SMA (red line). Should break below the aforementioned 50 SMA occur, then support at $564.48 may be at risk. Source: xStation5

Tesla (TSLA.US) stock managed to break above the downward trendline last week. Today the price bounced off the 50 SMA ( green line). If buyers manage to uphold momentum then upward move may accelerate towards local resistance at $654.21 which is strengthened by 200 SMA (red line). Should break below the aforementioned 50 SMA occur, then support at $564.48 may be at risk. Source: xStation5

Daily summary: Banks and tech drag indices up 🏭US industry stays strong

Largest in its class: What do BlackRock’s earnings say about the market?

US OPEN: Bank and fund earnings support valuations.

MIDDAY WRAP: Capital flows into European technology stocks 💸🔎