CarMax Inc (KMX.US), the nation’s largest retailer of used cars, plunged over 10% today in spite of the fact that the company’s results managed to beat market expectations. In the fiscal-second-quarter the firm’s earnings jumped 28% to $1.79 a share while analysts polled by FactSet expected a profit of $1.10 a share. Revenue rose 3.3% to $5.37 billion from $5.2 billion (vs expected: $5.2 billion). The company stated that positive comparable sales in July and August "more than offset" the high-single-digit negative comparisons from June when the coronavirus pandemic and lockdown were more severe. Moreover, CarMax completed the rollout of its omnichannel offerings, enabling customers to shop online and in person which might be of great importance in the months to come.

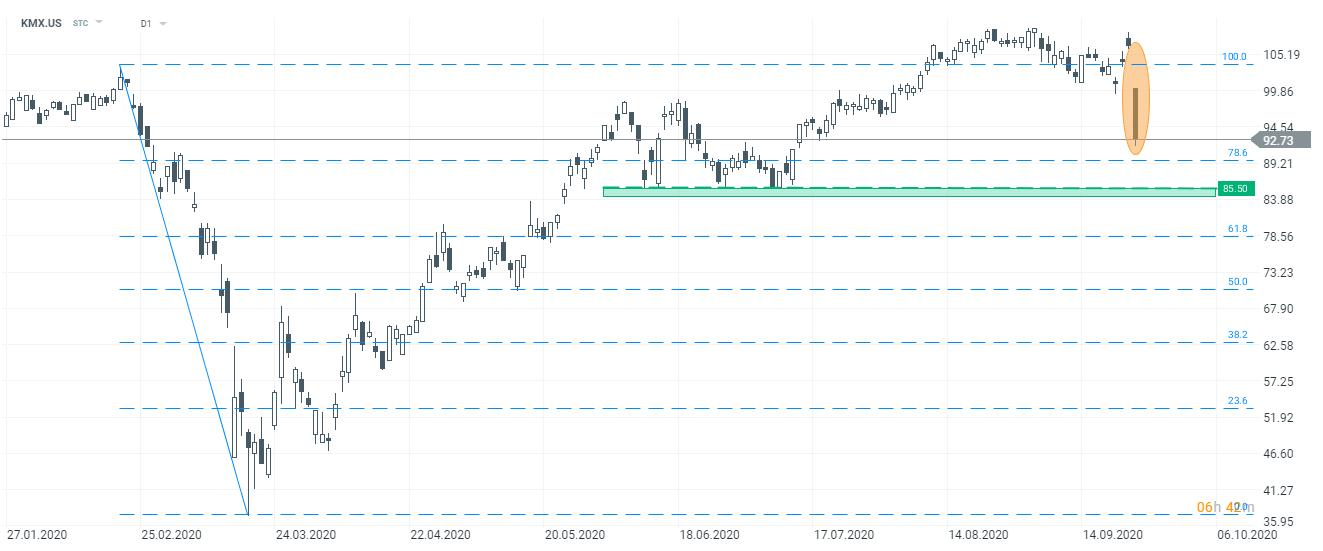

CarMax (KMX.US) surprisingly opened with a huge bearish gap despite better-than-expected earnings. The stock has been getting closer to the 78.6% Fibo retracement of the February-March drop. The $85.50 area may be viewed as key support level. Source: xStation5.

CarMax (KMX.US) surprisingly opened with a huge bearish gap despite better-than-expected earnings. The stock has been getting closer to the 78.6% Fibo retracement of the February-March drop. The $85.50 area may be viewed as key support level. Source: xStation5.

Kongsberg Gruppen after earnings: The company catches up with the sector

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

Morning wrap: Tech sector sell-off (06.02.2026)

Amazon shares tumble 10% as investors recoil at the price of AI dominance