Summary:

-

CB Consumer Confidence hits highest since Sep 2000

-

Little reaction seen in USD; Remains lower on the day

-

TRY and BRL drop after Argentine central banker resigns; USDIDX in S-H-S formation?

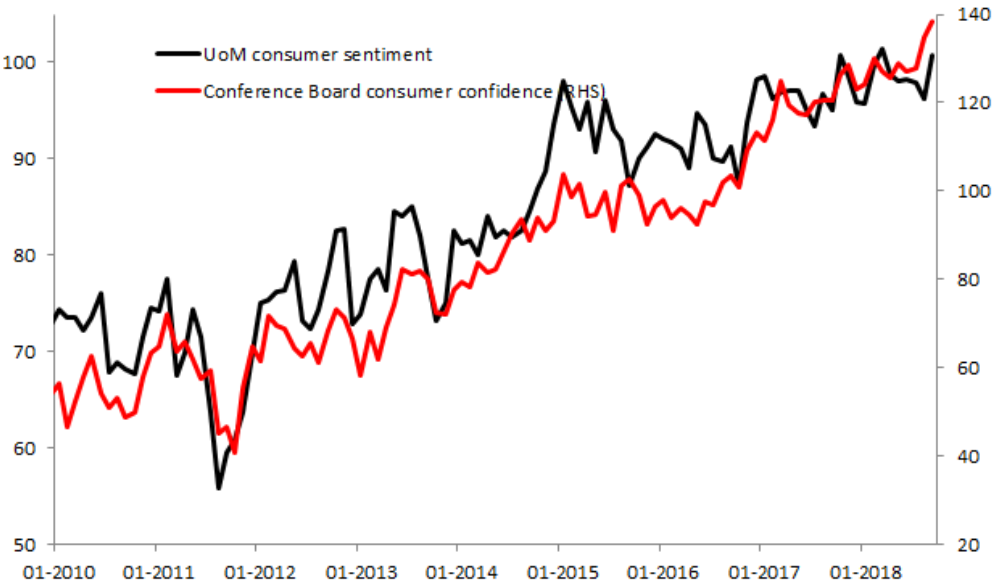

The most recent data on US consumer spending suggests this economic indicator is in rude health with a standout print, but it has seen a fairly muted reaction in the markets with the buck remaining a little lower on the day. The Conference Board consumer confidence index rose to its highest level since September 2000 in coming in at 138.4, well above the 132.2 expected and the prior reading was also revised higher for good measure (now 134.7 vs 133.4 previously). It’s not just the CB number that is surging higher of late with the Uni Mich equivalent also rising in recent months and taken together they give the impression that the US consumer is in a very confident mood at present.

Today’s CB release followed the suit of the latest Uni Mich in suggesting that the US consumer is in a buoyant mood of late. The CB number is in fact the higher since September 2000. Source: XTB Macrobond

This afternoon’s release is no doubt pleasing but given that it appears to be a continuation of the recent trend and also with the Fed rate decision tomorrow the market reaction has been fairly muted. The US dollar is trading slightly lower on the whole with traders likely in wait-and-see mode ahead of tomorrow’s event. The largest moves are seen in the USDTRY and USDBRL with both the Lira and Real coming under a bit of pressure after the Argentine central bank chief resigned.

The USD is a little lower on the day with the NOK, GBP and EUR all making small but steady gains. The TRY and BRL have been hit following the latest news from Argentina. Source: xStation

Luis Caputo gave in his notice due to “personal reasons” and the news has come as a blow for President Mauricio Macri who faces an ongoing struggle to restore investor confidence in the midst of a currency crisis. It should be pointed out that the declines are fairly controlled at present and we haven’t seen the sort of EM shock that occurred on other occasions in the past 6 weeks, with traders likely biding their time and awaiting the appointment of Caputo’s successor.

The USD index remains not far from a 3-month low heading into the Fed decision. A possible head and shoulders formation is in play after price broke below a possible rising neckline. Near-term the market is between supports at 93.40 and resistance at 93.90. Source: xStation

The USD index remains not far from a 3-month low heading into the Fed decision. A possible head and shoulders formation is in play after price broke below a possible rising neckline. Near-term the market is between supports at 93.40 and resistance at 93.90. Source: xStation