AUDJPY, an FX pair that is often perceived as a risk barometer, has been trading lower this week. The pair received a small boost today following the release of a solid jobs report from Australia. Employment increased 29.1k, more or less in line with estimates, while the unemployment rate dropped from 5.1% to 4.9% (exp. 5%). However, when it comes to Australia, the increase in new Covid-19 cases is somewhat worrisome. While case count is not high compared to the United States or countries from Western Europe, Australian authorities are focused on letting them increase. Victoria state, including Australia's second largest city Melbourne, will enter a 5-day lockdown starting today at midnight. Sydney, the country's largest city, will see a 2-week lockdown extension. Sydney and Victoria state combined account for almost half of the Australian GDP so lockdowns may weigh on the economy in case they continue to be extended.

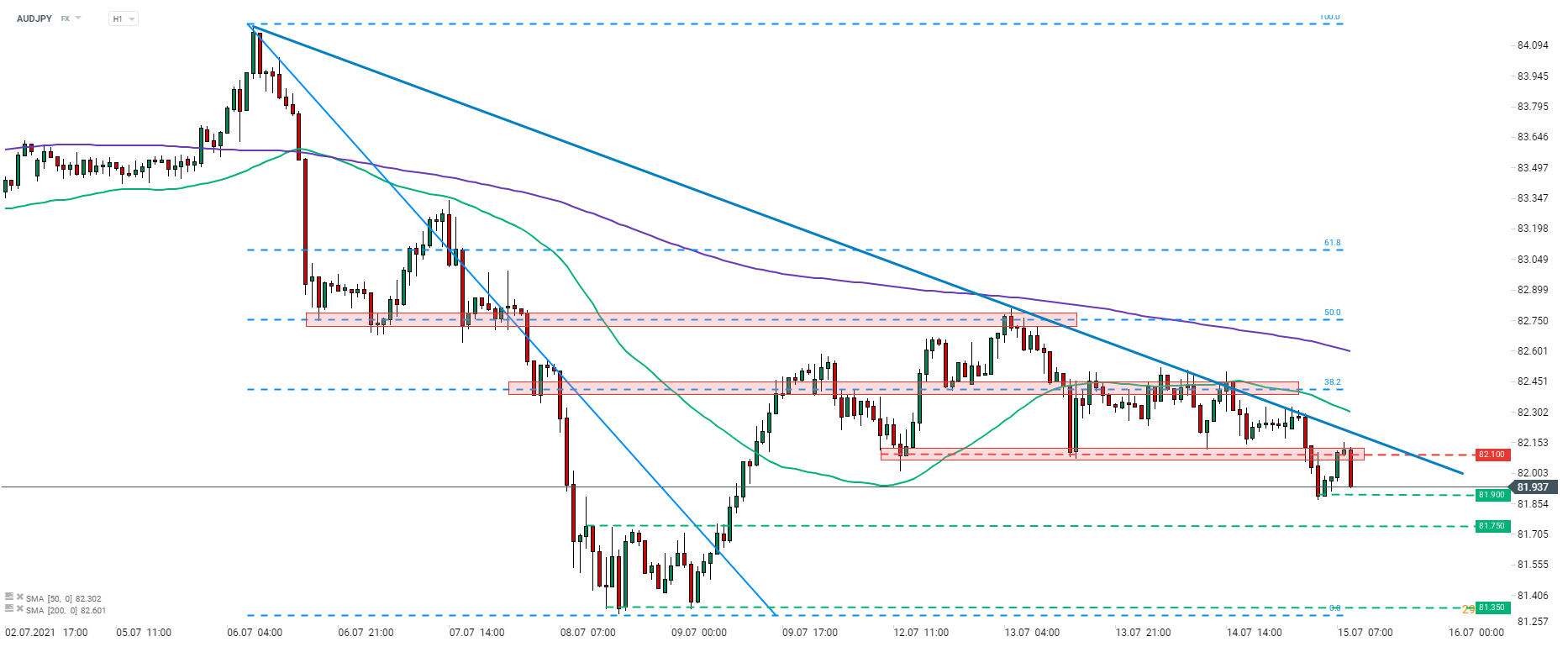

AUDJPY bounced off the 81.90 handle over the night. However, bulls were unable to break above the resistance zone ranging around 82.10 handle and a strong downward move was launched. Downtrend structure seems to be left intact and should we see a break below the aforementioned local low at 81.90, declines may accelerate. In such a scenario the two next support levels to watch can be found at 81.75 and 81.35.

Source: xStation5

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%