The Reserve Bank of Australia is set to announce its next monetary policy decision tomorrow at 5:30 am BST. RBA is expected to deliver another 50 basis point rate hike, pushing the main rate to 1.35%. This follows a 50 bp move at the last meeting. Note that the previous 50 basis point rate hike was a hawkish surprise as the market expected a 25 basis point move. RBA noted back then that inflation has increased significantly and expressed commitment to fight excessive price growth. RBA Governor Lowe suggested 2.5% as a reasonable neutral level of interest rates. While it looks like a done deal that the RBA will tighten, the question is whether it will continue with a 50 basis point rate hike pace or slow down to 25 bp moves.

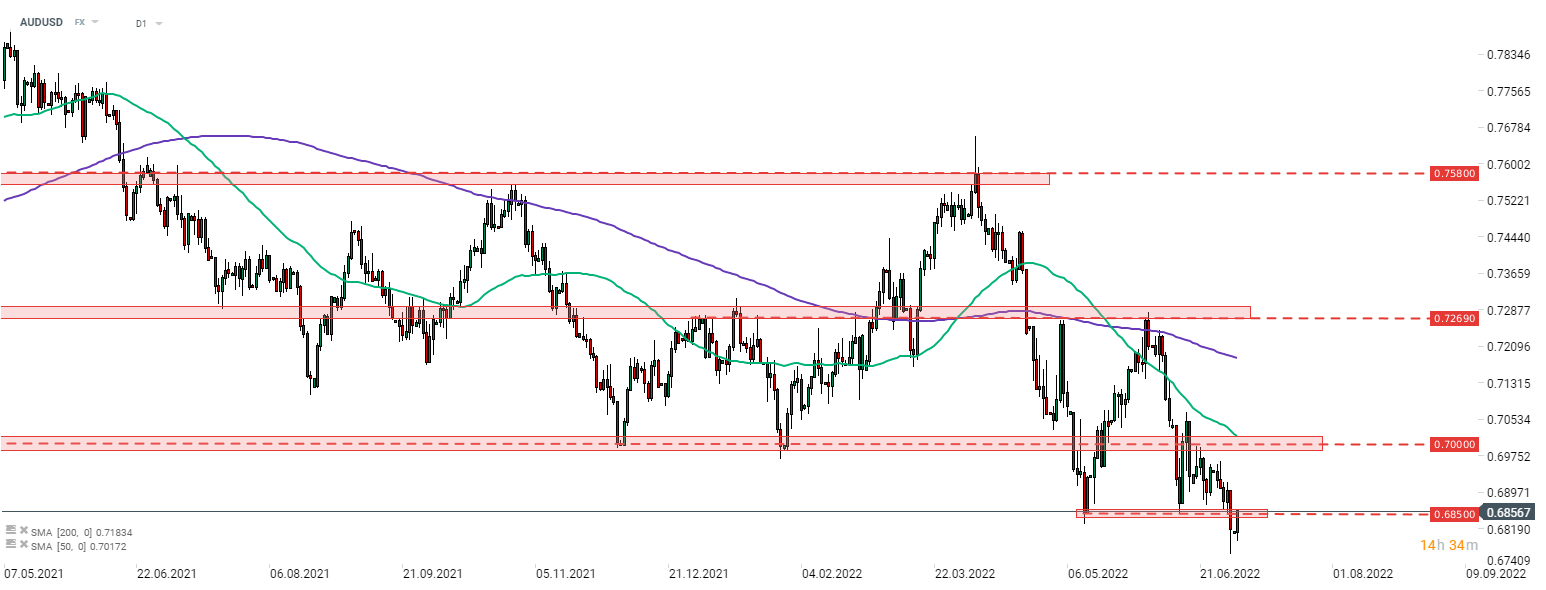

The Australian dollar is trading higher today and outperforms all other G10 peers. AUD benefits from improvement in moods, allowing AUDUSD to test a recently broken support level in the 0.6850 area. The pair broke below this area at the end of previous week and reached the lowest level since the beginning of June 2020. With market expectations centered around a 50 basis point rate increase, RBA is unlikely to deliver a hawkish rate surprise. However, guidance on the near-term rate path will be welcome. Should AUDUSD catch a bid a jump back above 0.6850 area, the next resistance to watch can be found in the 0.7000 area.

Source: xStation5

Source: xStation5

Another US Gov. Shutdown: What can it mean this time?

BREAKING: ISM data above expectations. EUR/USD under pressure

Market Wrap: Europe recovers, insiders selling, strong EU PMIs

Daily summary: A historic day for precious metals; SILVER loses 30%; USD gains 💡