The Australian Dollar is one of the weaker G10 currencies today following an unexpected drop in March retail sales. The report showed a decline across all subsectors except for food retail, which saw a 0.9% month-on-month increase. The clothing sector experienced the largest loss, declining by 4.3% month-on-month.

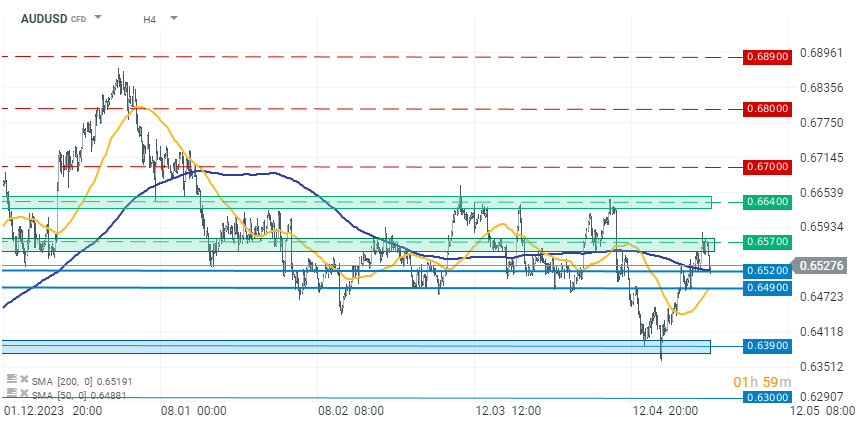

After the report's release, we observe declines in bond yields and the Australian Dollar. These declines extend the ongoing correction on the AUDUSD pair, which began after reaching a key resistance level around 0.65700. A single weaker report shouldn't affect interest rate trajectory in the longer term. However, if subsequent signals from the economy confirms this outlook, it could be a significant argument for the RBA. Retail sales are a key leading indicator directly correlated with inflation and growth prospects, potentially influencing the Reserve Bank of Australia's (RBA) hawkish stance on interest rate trajectory.

The Australian Dollar was relatively strong last week following a higher-than-expected CPI report. Inflation rose by 3.6% year-on-year in the first quarter compared to expectations of 3.4%. The current baseline scenario still assumes the first rate cuts only towards the end of the year, with speculation on no cuts at all. Weaker retail sales reports may prompt a change in this perspective.

Currently, AUDUSD is down by 0.60% to 0.65270, extending the correction that began around 0.65700. The first support zone is between 0.64900 and 0.65200, making movement in this zone crucial for the further trend detection from a technical analysis perspective.

Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️