While a market consensus had coalesced around the possibility of an RBA hike, several major investment banks remained outliers, betting on a hold. Consequently, the Reserve Bank of Australia has delivered a modest surprise to the upside—not merely through the move itself, but via its forward-looking stance. The RBA distinguishes itself as the first major central bank to pivot toward tightening in 2026, defying a global monetary landscape where many peers are still unwinding the post-2022 inflationary spike.

The RBA’s Gambit

The Reserve Bank of Australia raised its cash rate by 25 basis points, lifting the benchmark to 3.85% from 3.6%. This marks the first hike since February 2024. Only months ago, the prevailing narrative suggested further easing; however, a sharp hawkish pivot in late 2025, coupled with persistent price pressures, saw the probability of today’s move surge to 80%. The Board cited three primary catalysts:

-

Stubborn Inflation: Price growth accelerated faster than anticipated in H2 2025. Core inflation (trimmed mean) currently sits at 3.4%, remaining uncomfortably above the 2-3% target band.

-

Resilient Consumption: Household spending has gained momentum, a trend mirrored by robust business activity. Economic growth remains solid with signs of further acceleration.

-

Tight Labour Market: The unemployment rate has hit a seven-month low of 4.1%, while labour supply remains constrained.

While the RBA noted that some inflationary components may be transitory, it warned that the primary risk stems from supply-side pressures and a rapid recovery in private demand.

Macro Forecasts: A Significant Inflation Revision

The central bank’s updated economic projections reveal a more aggressive outlook:

-

GDP Growth: Forecast to remain near-trend this year before dipping more than a percentage point below trend in H2 2026.

-

Inflation (Trimmed Mean): Expected to hover around 0.9% q/q for the next two quarters (up from the typical 0.7%), ending 2026 at 3.2% y/y—still above the upper limit of the target range.

-

Unemployment: Projected to rise gradually as the tightening cycle takes hold.

Governor Michele Bullock noted that inflation is likely to remain above target for a "protracted period." While she remained non-committal on whether this marks the start of a sustained cycle or a one-off adjustment, institutional analysts are more hawkish. CBA anticipates another hike as early as May, while Westpac suggests the "bar for further tightening remains very low."

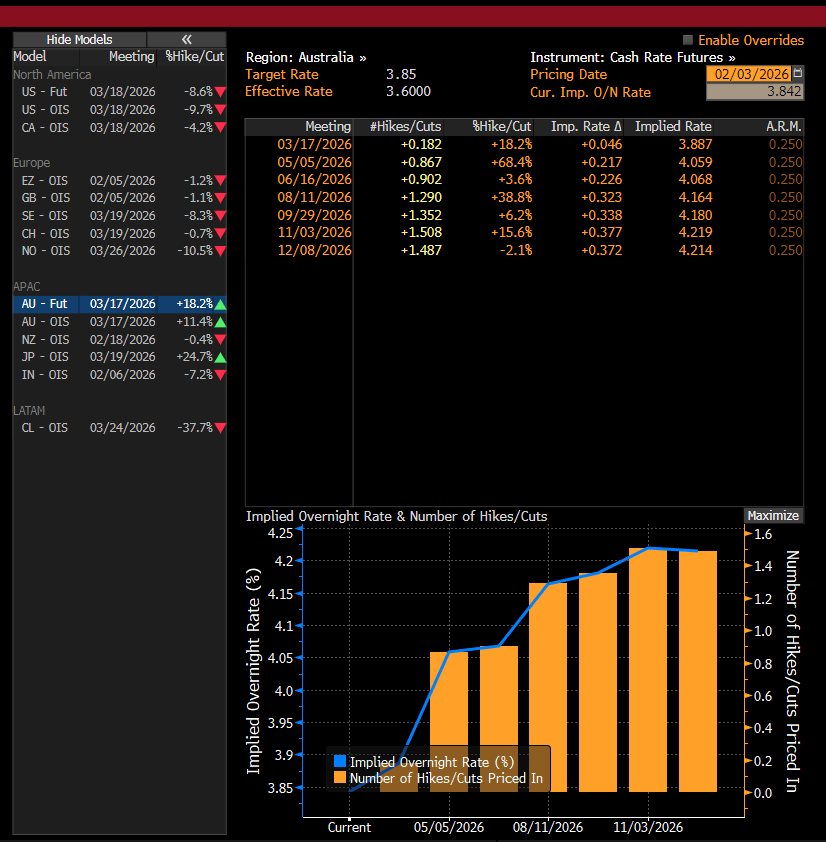

Market pricing currently implies a full hike may not arrive until August, though the probability for a May move has already climbed to 87%. Source: Bloomberg Finance LP

Technical Analysis

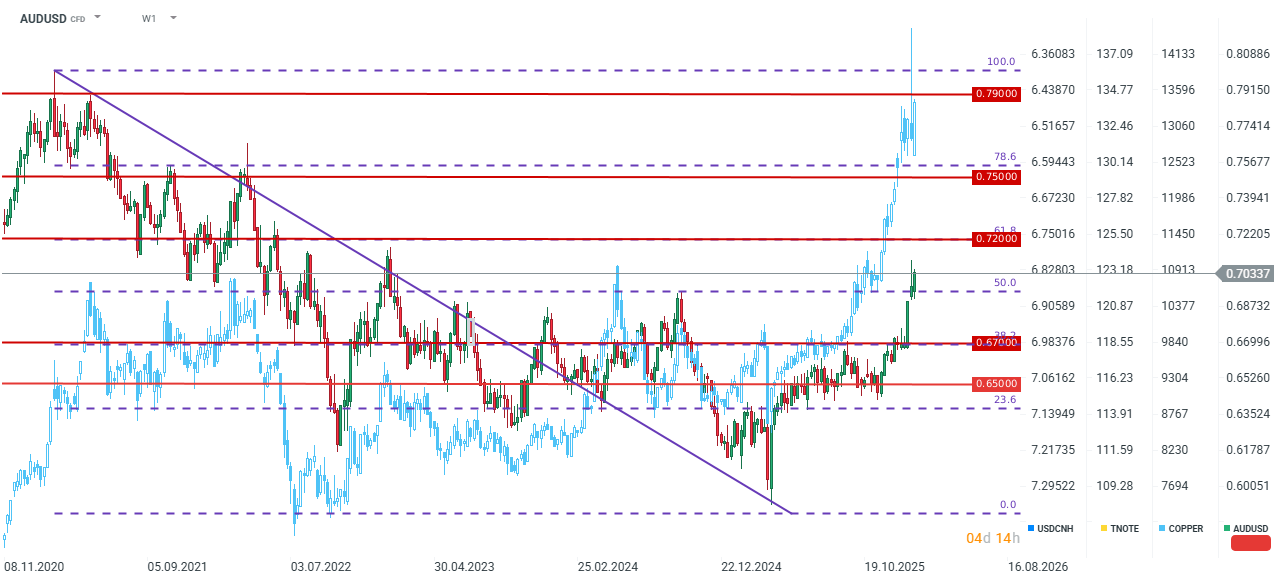

The AUD/USD pair has enjoyed a strong multi-week rally, currently testing the 0.70 handle. While the recent sell-off in commodities threatened a deeper correction, metals are rebounding: Copper is back near $13,000, Silver is approaching $90, and Gold has reclaimed $4,900. A daily close above this level for Gold could signal a "bullish engulfing" pattern, suggesting the end of the recent correction.

Trading at its highest level since February 2023, the "Aussie" appears well-positioned. A widening yield spread between Australia and the US, combined with the commodity super-cycle, could propel the pair toward the 61.8% Fibonacci retracement at 0.7200, with a medium-term target in the 0.74–0.75 range.

Three markets to watch next week (27.02.2026)

Daily summary: The beginning of the end of disinflation?

Wheat at its highest level in 8 months 📈

Jane Street: Legendary market maker in the court