Since the peaks on October 29 at 73,600 USD, Bitcoin has already lost 6.60%, and from Friday’s trading through the weekend, the price fell from 71,400 USD to as low as 67,600 USD in a local trough on Sunday. Today, the price is down 0.20%, holding around 68,600 USD.

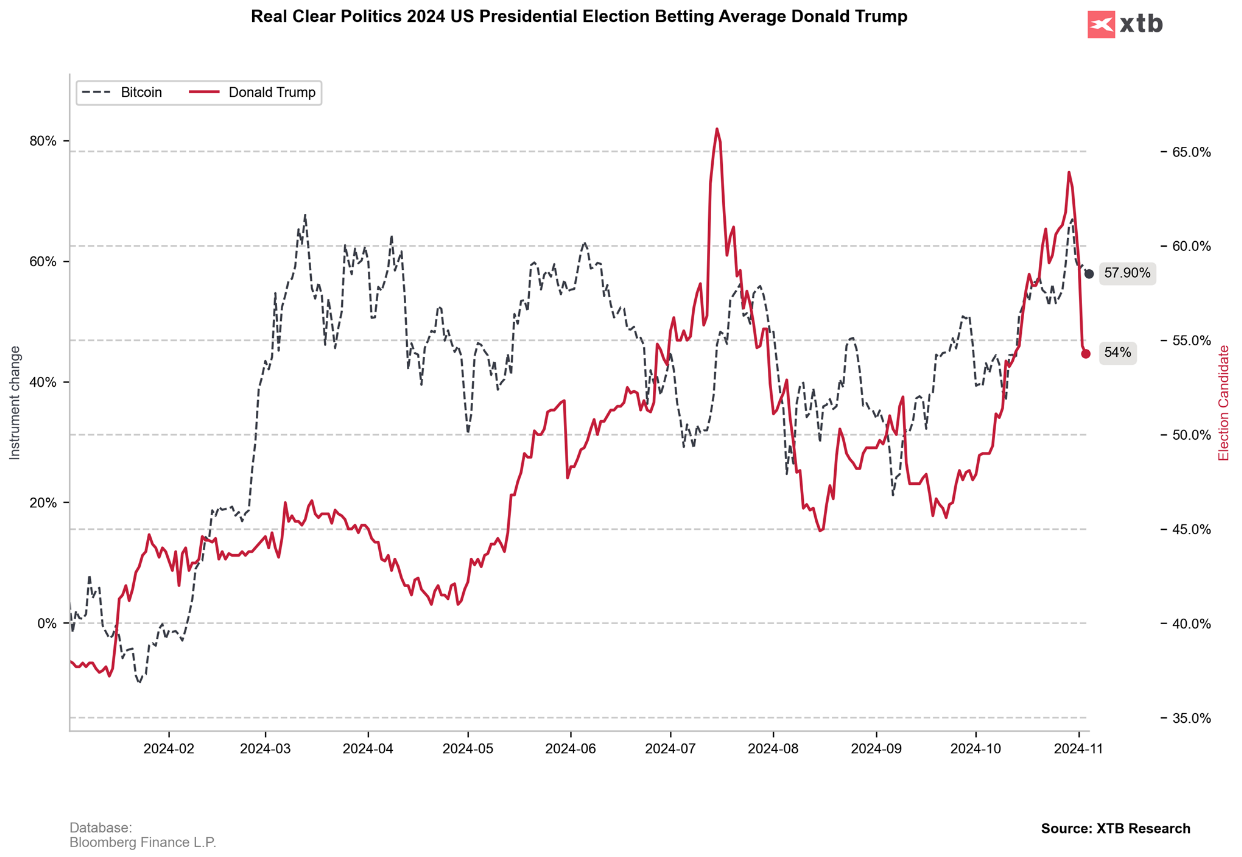

This sharp decline is the result of the upcoming elections in the USA and a significant drop in betting odds favoring Trump's victory. Speculators are taking profits as the final election date approaches. In recent weeks, we have seen substantial gains across various assets that reflected the strong chances of a Republican candidate victory. Betting markets had priced in close to a 70% probability of Trump's win at the peak, which had also driven up stock indices, Bitcoin, the dollar, and bond yields. We experienced the burst of this small bubble over the pre-election weekend. With only hours left until tomorrow’s election, market volatility is expected only to rise.

The significant drop in Bitcoin over the weekend and the considerable sell-off in the dollar early today are both due to reduced expectations of a Trump victory, even though nothing has fundamentally changed. The cryptocurrency market's decline may also hint at a similar sell-off at the start of the U.S. cash session later in the day. The cryptocurrency market clearly favors a Republican win. Therefore, volatility could remain elevated this week. On the other hand, in the long term, it shouldn’t have a major impact. From a neutral perspective, many steps have been taken toward regulating this market, including the introduction of BTC and ETF products during Joe Biden’s presidency, despite initial skepticism.

Technical analysis suggests that the most critical level to maintain remains the area below 68,000 USD, which managed to hold over the weekend.

_c34472f510.png)

Source: xStation 5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Bitcoin jumps above $70k USD despite stronger dollar📈

Daily summary: Markets capitulate under the influence of the Persian Gulf