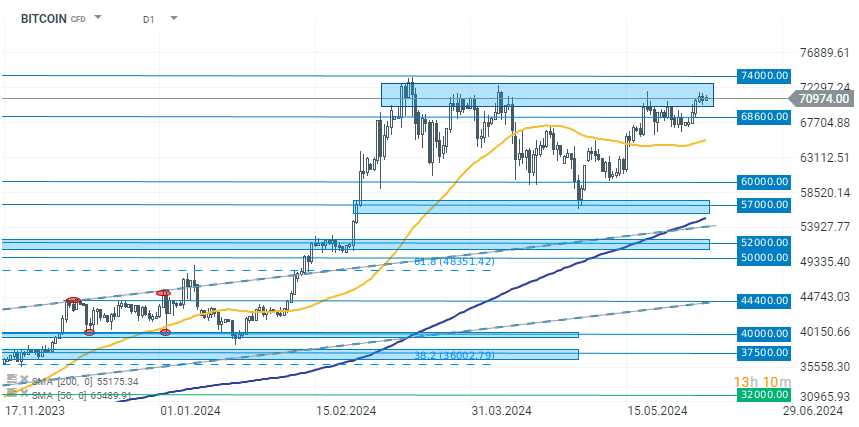

Bitcoin is gaining 0.45% today and is once again above the $71,000 level. However, the resistance above this level is strong enough that even record ETF inflows are unable to break through it. Looking at previous cycles, Bitcoin returned to growth 2-3 months after a halving following a period of correction or consolidation. In this scenario, the current consolidation should not be a significant surprise.

However, it is important to remember the current macroeconomic environment. High interest rates continue to exert pressure on the economy, and the effects are becoming increasingly noticeable. The risk of recession still exists, and in such a scenario, it is hard to imagine a sustained bull market in risky assets such as cryptocurrencies. Today's labor market report could also significantly impact the cryptocurrency market. In recent months, Bitcoin has become particularly sensitive to the broader financial market situation due to the increasing share of external capital. Therefore, the data release could determine whether Bitcoin breaks above $71,000 or undergoes another correction to around $70,000 or below.

Source: xStation 5

Bitcoin jumps above $70k USD despite stronger dollar📈

Daily summary: Markets capitulate under the influence of the Persian Gulf

Crypto news: Bitcoin gains almost 2% despite the war in the Middle East 📈

Jane Street: Legendary market maker in the court