A surprise 50 basis point rate hike delivered by Swiss National Bank yesterday triggered strong risk-off moves in the market. A surprise move from one of the most dovish central banks in the world was a clear message that inflation is no joke and strong actions are needed. Move from the SNB made some question whether the Bank of Japan will indeed stay on hold today or whether it will also start to tighten policy. BoJ decided not to change its policy and left all monetary policy settings unchanged - as markets expected. Moreover, BoJ Governor Kuroda gave little hopes for a near-term policy change during a post-meeting press conference. In fact, the whole meeting and press conference can be seen as dovish as Bank of Japan not only maintained its asset purchase programme but even decided to increase the limit for consecutive purchases from 50 to 70 days.

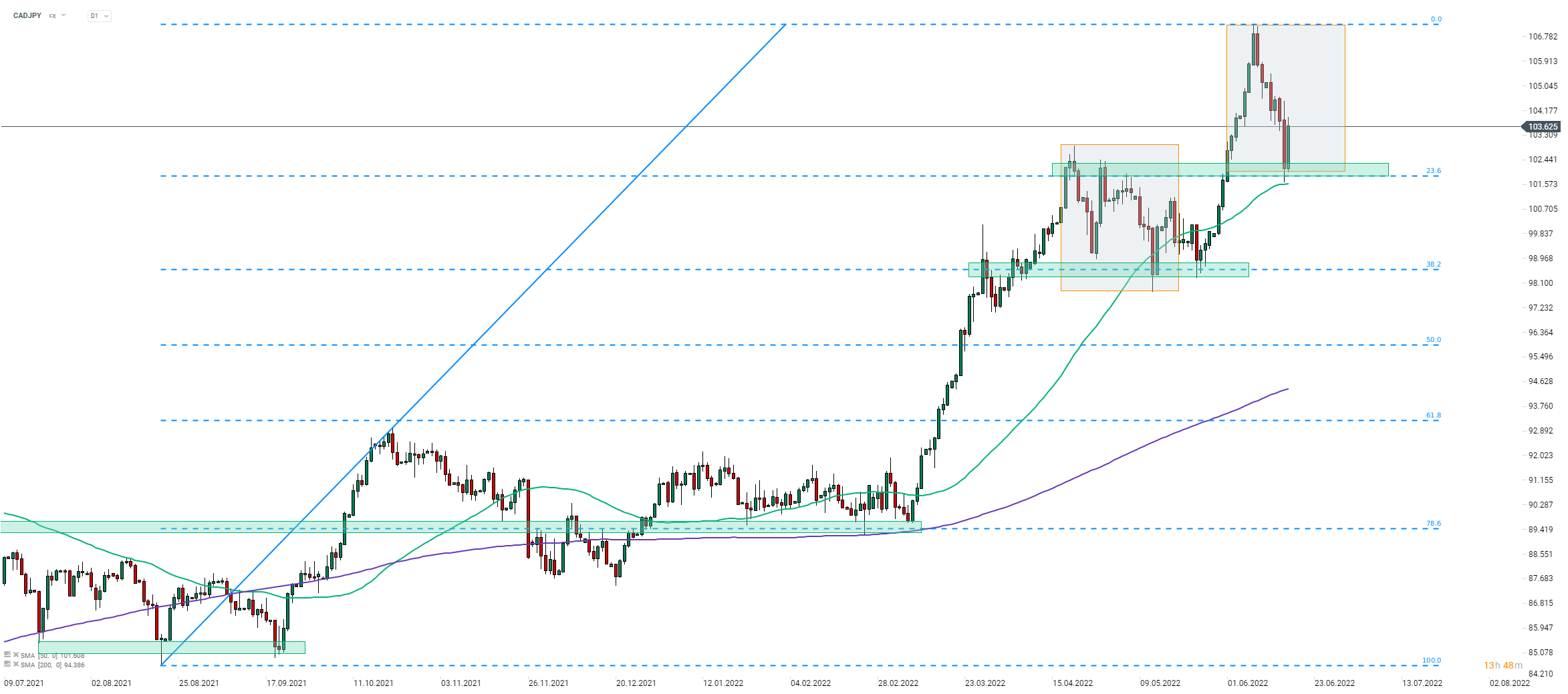

Given the above, one should not be surprised by JPY weakness today. Taking a look at CADJPY at D1 interval, we can see that the pair has halted recent correction today and managed to bounce off the 102.00 area. This zone is marked with local highs from late-April, lower limit of the market geometry as well as 23.6% retracement of the upward impulse launched in late-August 2021. A positive demand reaction to this hurdle hints that a resumption on the upward move may be underway and return towards recent peak at around 107.20 may be on the cards.

Source: xStatiokn5

Source: xStatiokn5

Morning Wrap - Oil price is still elevated (07.03.2026)

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸