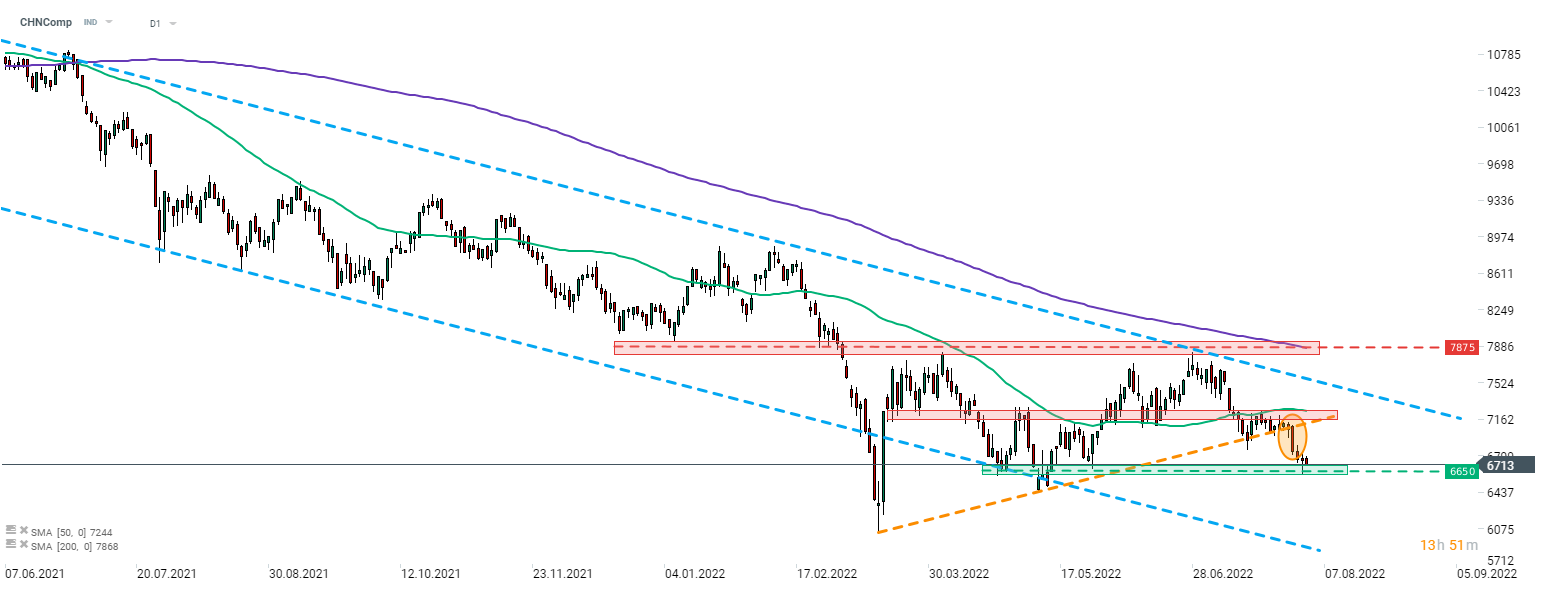

Chinese stock markets have been trading lower for almost a year and a half now. CHNComp index has dropped 45% off its February 2021 peak and recent price action does not bode well for buyers. A brief upward correction on CHNComp was halted by the 7,875 pts resistance zone at the end of June and the index resumed slide. Price broke below a short-term upward trendline amid an increase in Sino-US tensions over Taiwan. Index has later reached a short-term support in the 6,650 pts area and whether it manages to break below it is yet to be seen. If it breaks below the area, a downward move towards the lower limit of the long-term downward channel (currently in the 5,900 pts area) may come next.

Chinese equities may remain under pressure for as long as the situation around Taiwan remains tense and uncertain. Of course, a weakening Chinese economy and problems in the domestic real estate sector are also playing a role, and in fact are prime reasons behind an over-year long downward move on CHNComp but recent acceleration is related to Pelosi visit and a risk of escalation in Sino-US relationship.

Source: xStation5

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes