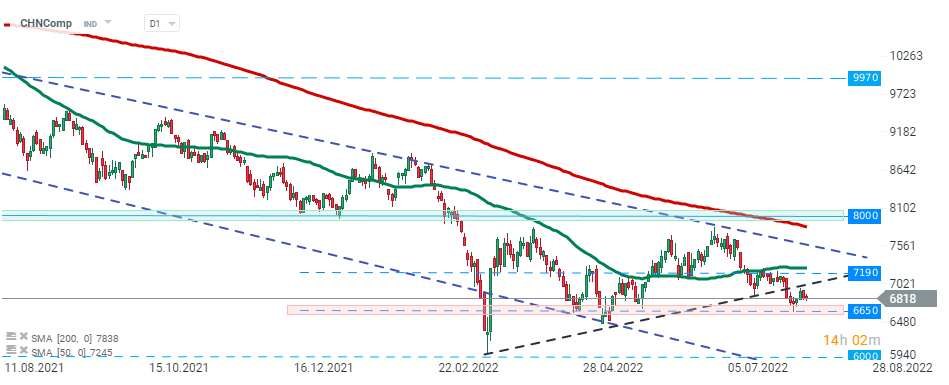

The Chinese CHNComp index remains under pressure on Monday despite the fact that recent trade data from the world's second biggest economy released over the weekend surprised to the upside, raising hopes for an economic rebound. Nevertheless, Chinese equities may remain under pressure for as long as the situation around Taiwan remains tense and uncertain. Also investors remained cautious following a surprisingly strong NFP report that bolstered the Federal Reserve’s firm hawkish stance, ahead of the release of US inflation data this week. Recent upward correction was halted around 7190 pts and the index resumed slide and broke below the upward trendline. Index has later reached a short-term support in the 6,650 pts area. Should break lower occur, downward move towards the lower limit of the wedge formation (currently in the 6,000 pts area) may come next.

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report