Global markets have calmed after yesterday's turmoil that was triggered by a combination of a few factors - Moody's rating agency downgrading a number of US banks, Italy approving a windfall tax on 2023 bank profits and China releasing disappointing trade data for July. Major European stock markets indices launched today's trading with around 1% gains and an empty economic calendar suggests that things may remain calm until US CPI release tomorrow at 1:30 pm BST.

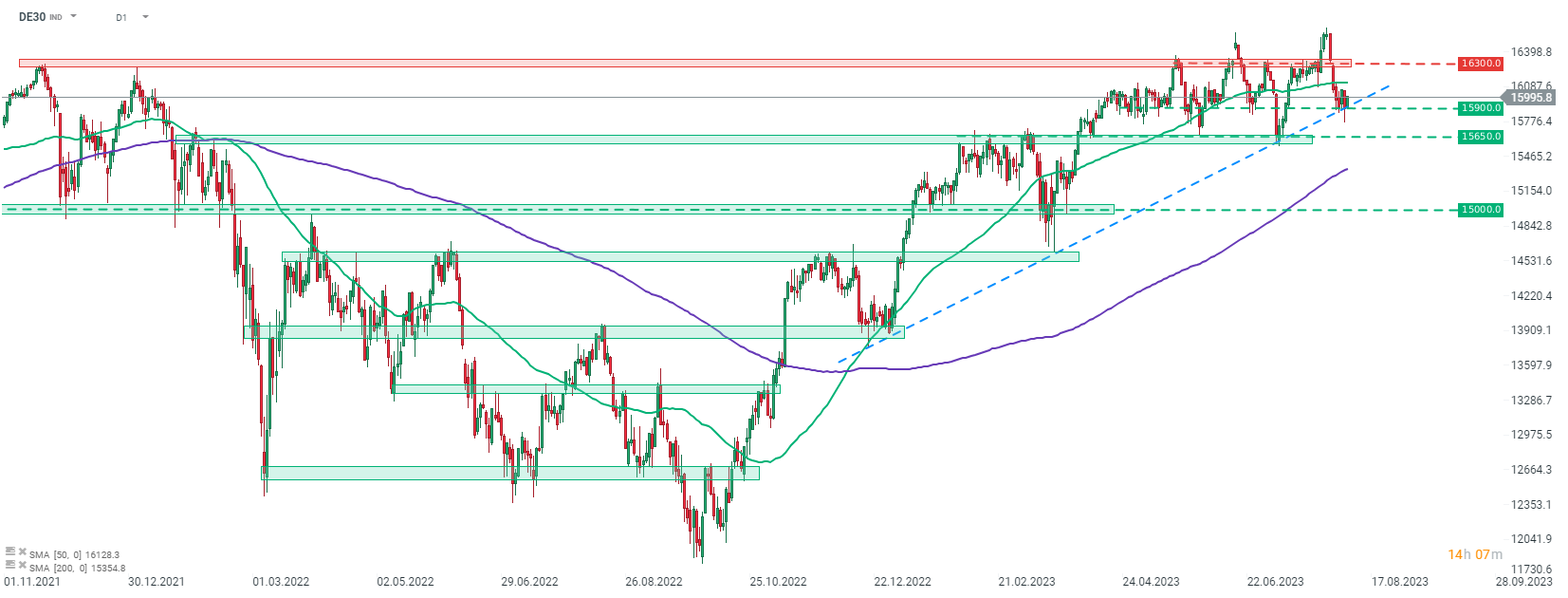

German DAX is trading 1% higher on the day. Taking a look at DAX futures (DE30) at D1 interval, we can see that the index is attempting to break back above the psychological 16,000 pts mark. Bulls managed to halt declines and defend the upward trendline in the 15,900 pts area. It should be noted that DE30 has been largely stuck in the sideways move in the 15,900-16,300 pts range over the past 3-4 months, spare for few false breakouts. A positive price reaction to the lower limit of the range suggests that a move towards the 16,300 pts may be next. However, a stronger catalyst may be needed to push the index above the trading range.

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report