There are two big market events scheduled for today. Investors will be offer a monetary policy announcement from the European Central Bank at 12:45 pm BST as well as a US retail sales report for March at 1:30 pm BST. Both of those events could be volatility triggers for EURUSD.

When it comes to the European Central Bank monetary policy decision, nobody expects the level of interest rates to be changed. However, there is no consensus when it comes to asset purchases. Some banks expect the ECB to announce the end of APP by the end of May today and start preparing markets for a potential rate hike as soon as June. Others, however, do not expect such an announcement ahead of the June meeting as this will be when the updated set of economic forecasts is released. Nevertheless, scope for a surprise today remains and ECB President Lagarde is likely to be questioned about future outlook during a press conference at 1:30 pm BST.

On the other hand, things are not as puzzling when it comes to the US retail sales data release. Headline reading for March is expected to show a 0.6% MoM growth after a lackluster 0.3% MoM increase in February. Core gauge (excluding cars and fuel) is seen jumping 0.9% MoM, following a 0.4% MoM drop in the previous month. The report will be closely watched however as it will capture the first full month since the beginning of Russian invasion of Ukraine and may show whether US consumers began to spend more cautiously amid deteriorating inflation outlook.

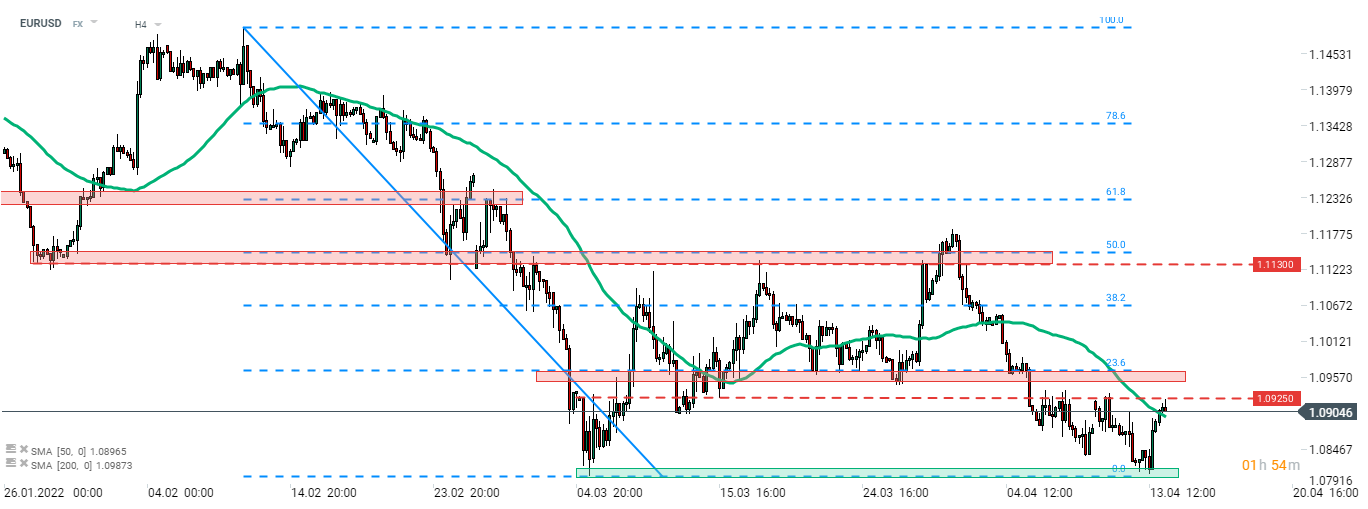

Taking a look at EURUSD chart at H4 interval, we can see that the main currency pair managed to recover from the 1.08 area, marked with local low from early-March. Subsequent recovery move push the pair towards 1.0925 short-term swing level. A break above would be a bullish sign and may herald a test of the resistance zone ranging below 23.6% retracement of the February correction. On the other hand, two previous attempts of breaking above 1.0925 area failed.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)