Release of US GDP data, flash CPI inflation from Germany and panel discussion with heads of Fed, ECB and BoE are all scheduled for today. While US data will be a revision and is not expected to trigger any big moves, inflation data from Europe and speeches from top central bankers may provide some volatility for EURUSD. Let's take a look at the technical situation on the main currency pair.

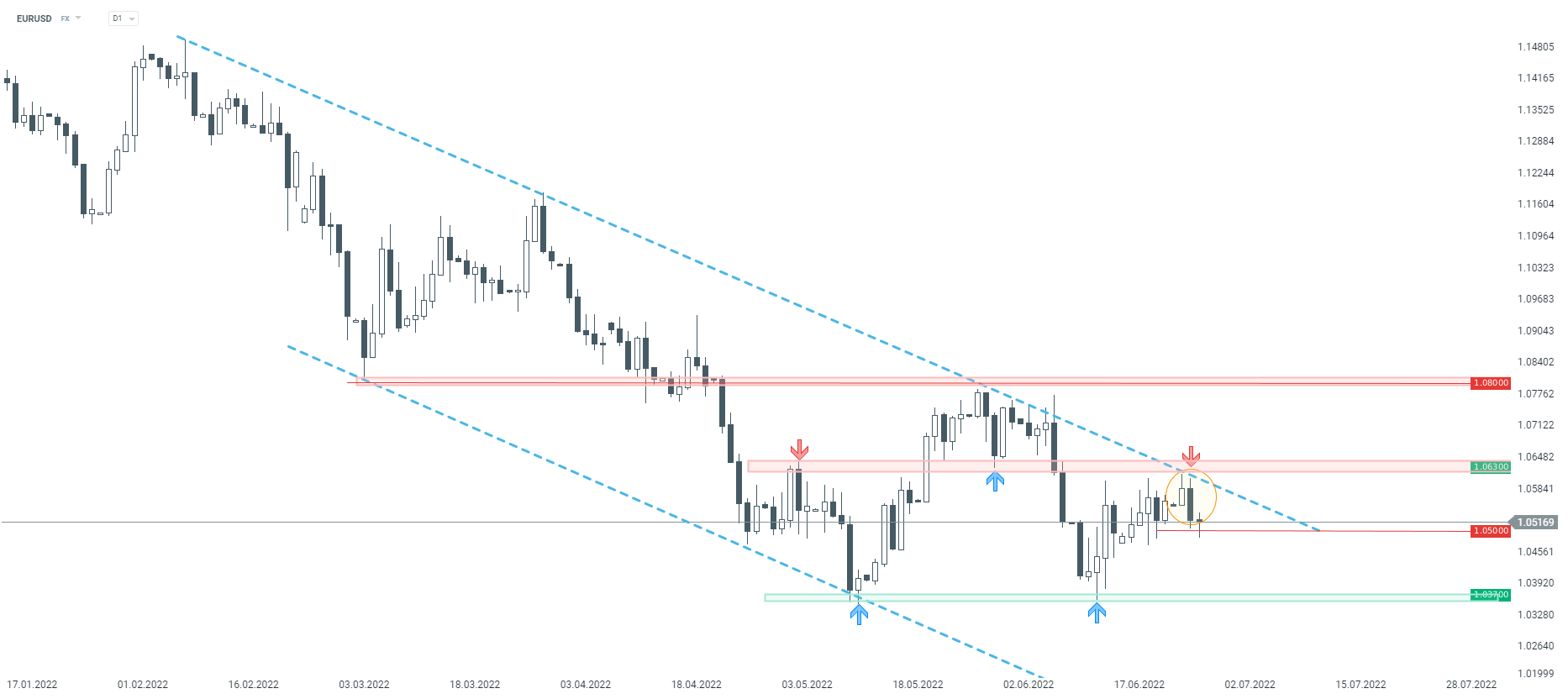

Taking a look at EURUSD chart, we can see that the pair has been trading in a downward move for some time. Even as buyers managed to paint a double bottom on the chart, the pair struggles with breaking back above 1.0630. The most recent attempt of breaking above has triggered a pullback and a bearish engulfing pattern surfaced on D1 interval. A move back towards recent lows in the 1.0370 area cannot be ruled out. However, a 1.05 area may provide some short-term support.

Source: xStation5

Source: xStation5

3 markets to watch next week (05.12.2025)

BREAKING: Lower Unemployment in Canada🍁USDCAD sharply declines📉

BREAKING: Euro-zone GDP slightly above expectations!📈 EURUSD remains stable

BREAKING: Germany industrial orders for October higher than expected; EURUSD gains 📌