The Bank of Japan decided to leave interest rates and other monetary policy settings unchanged at a meeting today. Such a decision was expected and no one even thought that Bank of Japan could pull the trigger and hike rates. As such, today's BoJ meeting was largely a non-event. Comments from Japanese deputy finance minister Masato Kanda, who is also considered Japanese top FX diplomat, attracted much more attention. Namely, Kanda said that his country did not intervene in the FX markets but is ready to do so if needed. He also said that if it comes to this, it would most likely be "silent intervention".

We did not have to wait long for the intervention and it definitely was not a silent one. USDJPY slumped at 9:00 am BST as the Bank of Japan and Japanese government intervened by buying JPY against USD, leading to an around 100 pip drop in the pair. Downward move deepened further after Kanda confirmed at 9:15 am BST that intervention indeed took place. Kanda said that the government is concerned about excessive depreciation of JPY and will monitor markets with a high sense of urgency. The pair is now trading more than 300 pips off a daily high. This was the first direct intervention in the FX market to prop up JPY since 1998.

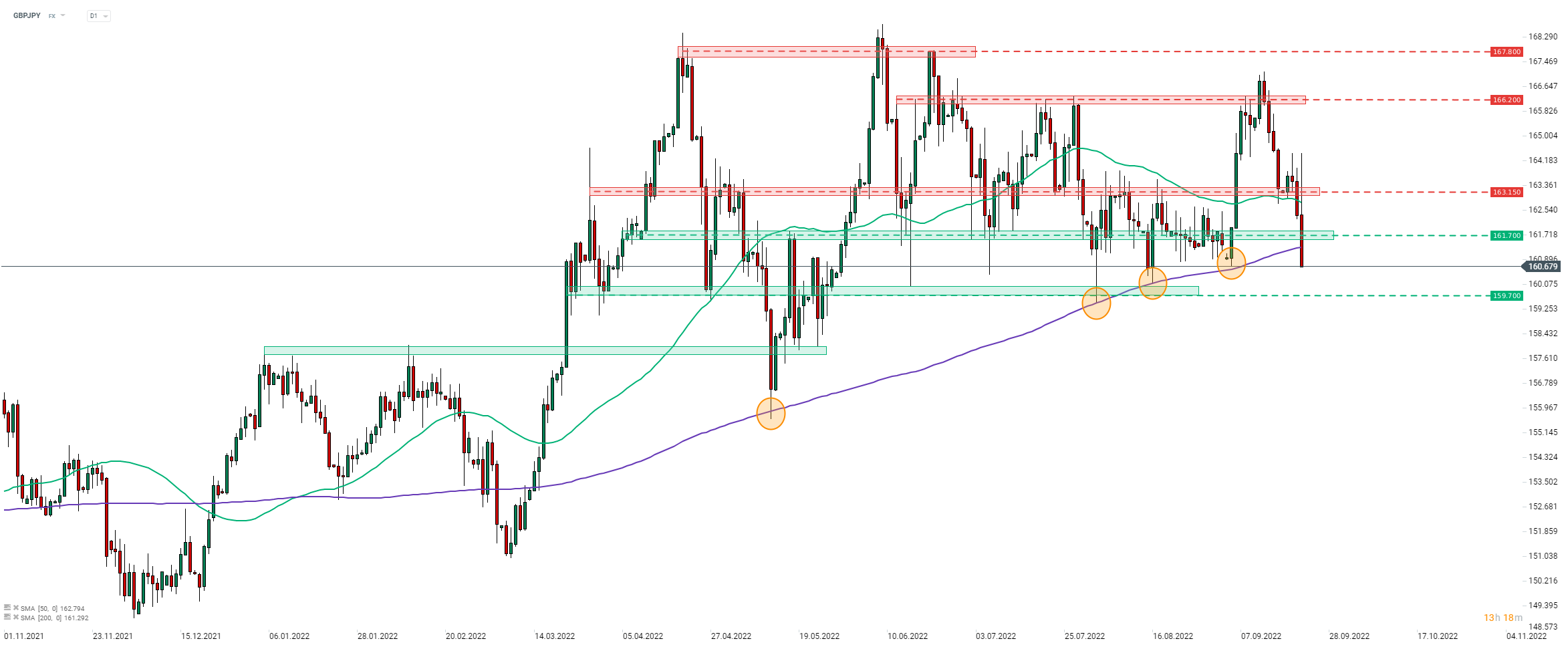

While the attention is centered on USDJPY, as this is where intervention took place, the situation on the other JPY-tied FX pairs is also interesting. GBPJPY is one such pair. Taking a look at the chart at D1 interval, we can see that the ongoing pullback on the pair deepened significantly today and the pair is making its way below the 200-session moving average (purple line). This moving average provided support for the pair in recent months (orange circles on the chart) and a break below can hint at potential trend reversal. The pair is expected to remain volatile today as Bank of England is set to announce its rate decision at 12:00 pm BST.

Source: xStation5

Source: xStation5

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)