Sterling remains under pressure as UK inflation uptick complicates BOE policy outlook, with markets scaling back rate cut expectations for 2025 amid persistent price pressures and wage growth concerns. All eyes turn to today's Federal Reserve decision, where a 25bp rate cut appears nearly certain, potentially adding downward pressure on cable as policy divergence between the Fed and BOE widens.

Key Market Statistics:

- UK CPI rises to 2.6% in November (from 2.3% in October)

- Services inflation holds steady at 5.0%

- Core inflation increases to 3.5% (from 3.3%)

- GBP/USD trading around 1.27 level

Rate Cut Expectations

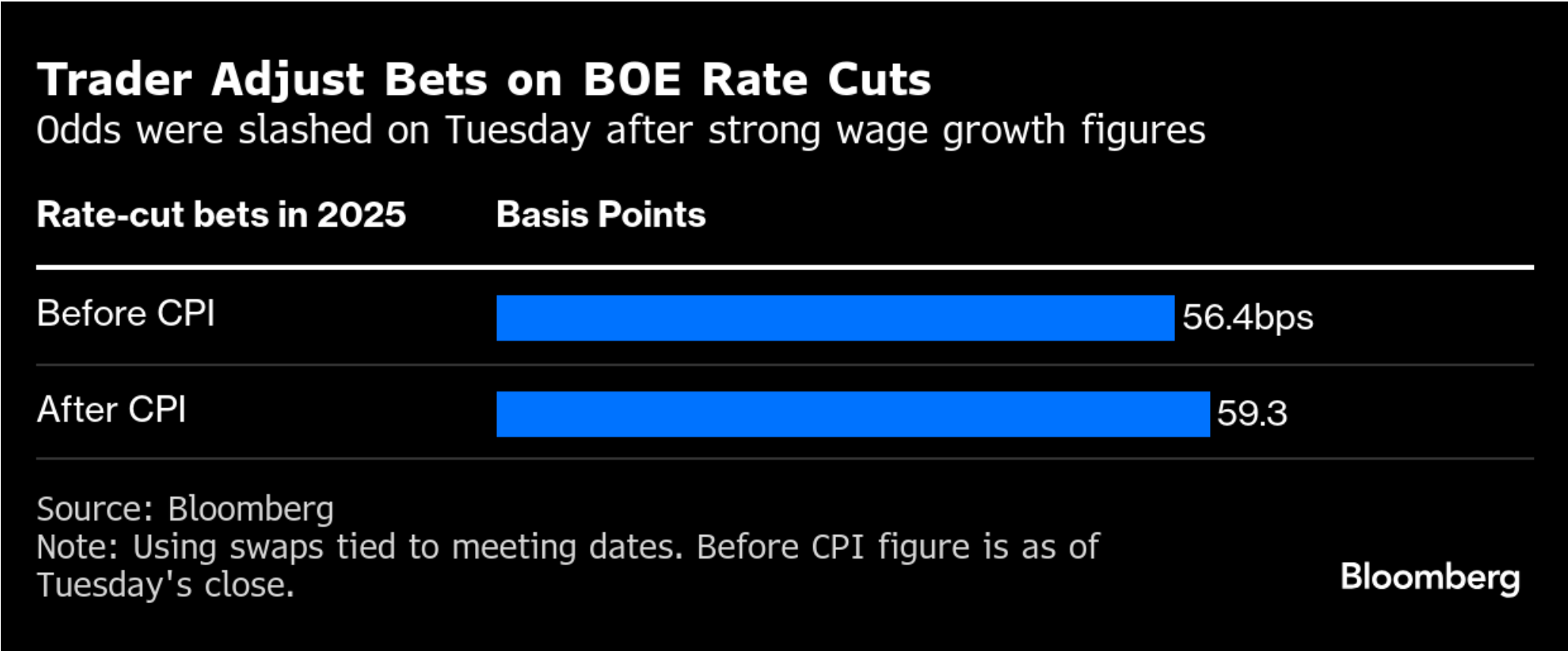

The pound's movement reflects growing market recognition that the BOE faces a more complex policy path than its global peers. While traders had previously priced in three rate cuts for 2025, expectations have now shifted to just two cuts, highlighting the stubborn nature of UK inflation compared to other major economies.

Rate Cuts in 2025 after yesterday’s data. Source: Bloomberg

Services Sector and Wage Pressures

The sustained high services inflation at 5.0% (above BOE's 4.9% projection) coupled with accelerating wage growth at 5.2% suggests persistent domestic price pressures. The underlying "core" services inflation, excluding volatile components, has actually picked up to 5.3% from 5.1%, indicating broader-based inflationary pressures.

UK CPI Contributions in November. Source: Bloomberg

Policy Divergence Emerging

While the Fed and ECB show increasing openness to rate cuts, the BOE appears positioned to maintain a more hawkish stance. Markets are now pricing approximately 60 basis points of easing through 2025, with the probability of a February cut at around 60%. This policy divergence could provide some support for sterling, though economic growth concerns may limit upside potential.

Market Implied Rate Cuts. Source: Bloomberg

2025 Outlook

The combination of sticky inflation, labor market tightness, and potential fiscal policy impacts from the Labour government suggests the BOE will likely maintain a cautious approach to monetary policy easing. Analysts now project the bank rate to end 2025 at 3.75%, reflecting a measured quarterly pace of cuts rather than the more aggressive easing previously anticipated.

The complex interplay between persistent inflation, wage pressures, and growth concerns suggests continued volatility in sterling pairs through early 2025, with policy divergence remaining a key driver of currency movements.

GBPUSD (D1 Interval)

GBPUSD is currently trading below the 23.6% Fibonacci retracement level, a key inflection point that has held firm for over 19 trading days, leading to breakouts and signaling strong resistance.

For bulls, the primary target is the 38.2% Fibonacci retracement level at 1.28484, with the first challenge being a successful breakout above the 50-day SMA. Conversely, bears will aim for the November lows at 1.24866 as their key target.

The RSI shows slight bearish divergence with lower highs but remains in the neutral zone, providing no definitive signal. Similarly, the MACD has remained tight for several days, reflecting market indecision and the absence of a clear directional bias. Source: xStation

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

Daily summary: Markets capitulate under the influence of the Persian Gulf

🚨 EURUSD deepens decline, falls to key support zone