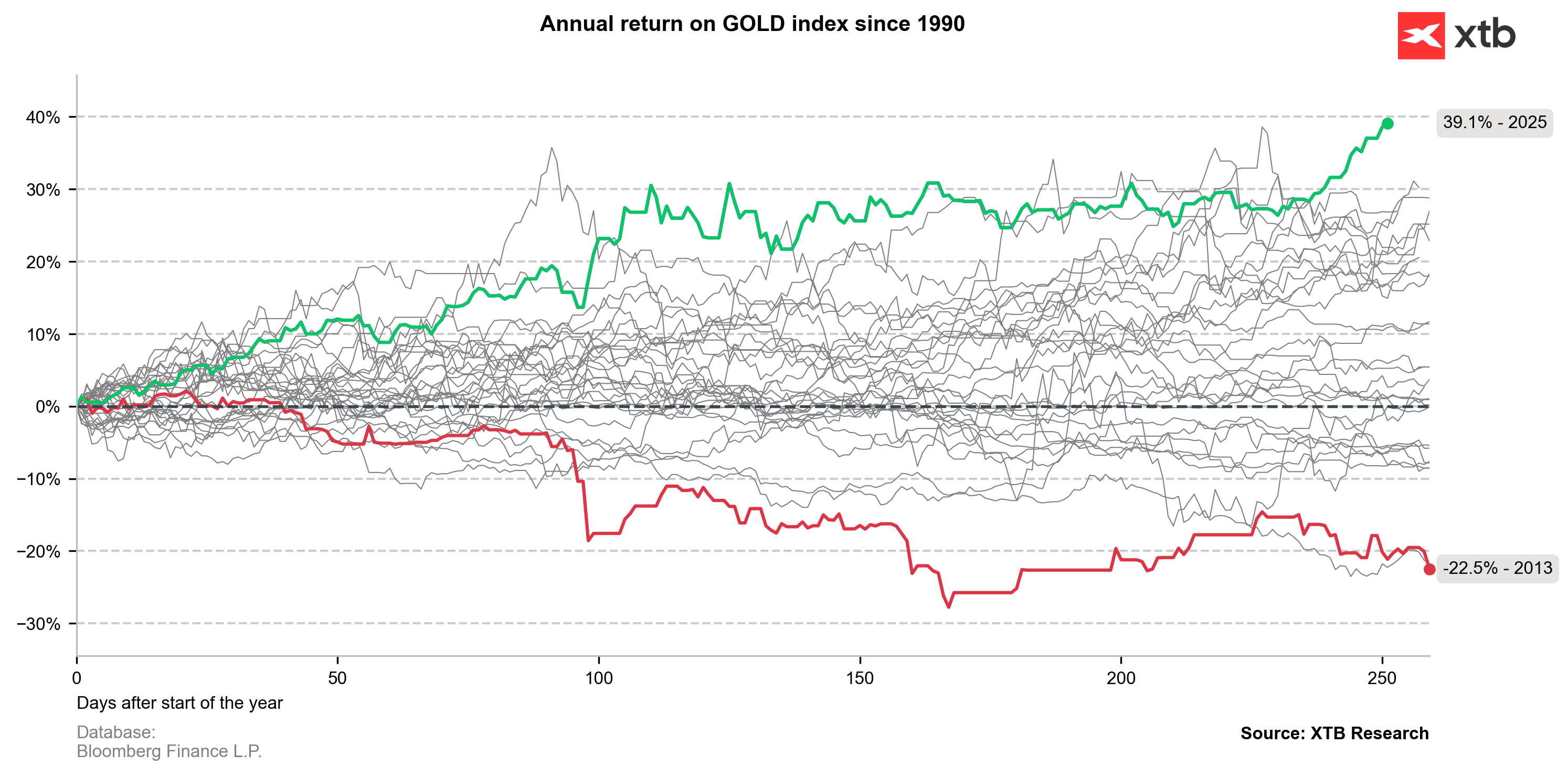

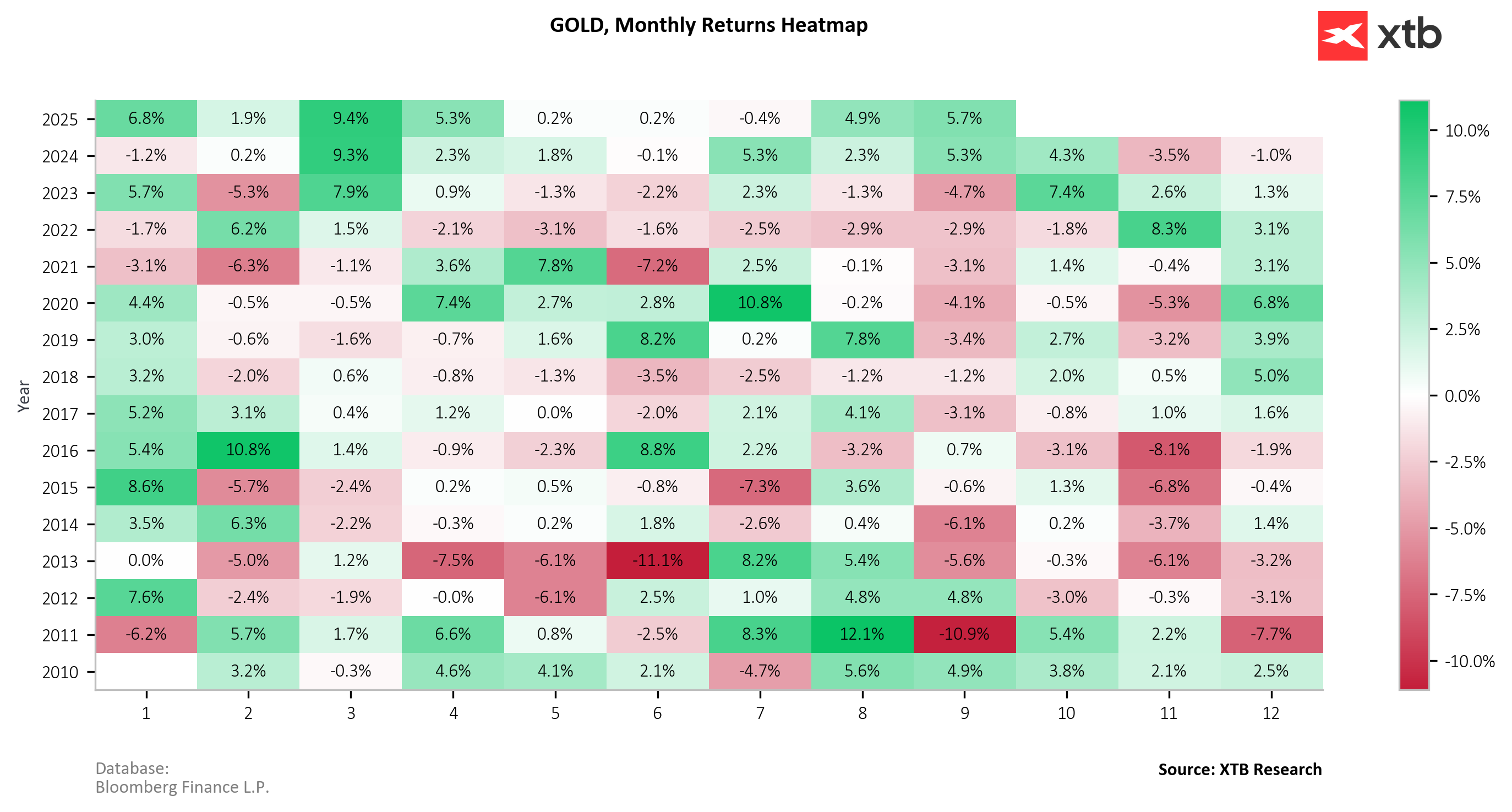

Gold prices are setting new record highs today around $3,650/oz. Since the beginning of the year, gold has gained more than 39%, marking the strongest average annual increase in the period under review since 1990.

Such a dynamic rise is based on expectations of Fed rate cuts and lower real yields, as well as political-trade instability and high fiscal deficits across economies. The global bond sell-off and equity market volatility are reinforcing flows into “safe havens.” In addition, reserve diversification away from the USD continues to drive demand for gold.

Gold is recording yet another impressive month this year. Ahead lie the final three months, which historically have been the most bullish for gold.

Demand is further supported by ongoing central bank purchases. Notably, El Salvador made its first gold purchase since 1990 (around 14k ounces), as part of diversification away from Bitcoin. Beyond individual cases, emerging market central banks (including China) are accumulating gold at a record pace. The current industry consensus assumes that dips will be bought, maintaining “solid support” for the metal in the months ahead.

Crypto news: Bitcoin rebounds above $90k amid optimism on Wall Street📈

Chart of the day: OIL.WTI (08.12.2025)

Daily Summary: Wall Street ends the week with a calm gain 🗽 Cryptocurrencies slide

NATGAS surges 5% reaching 3-year high 🔎