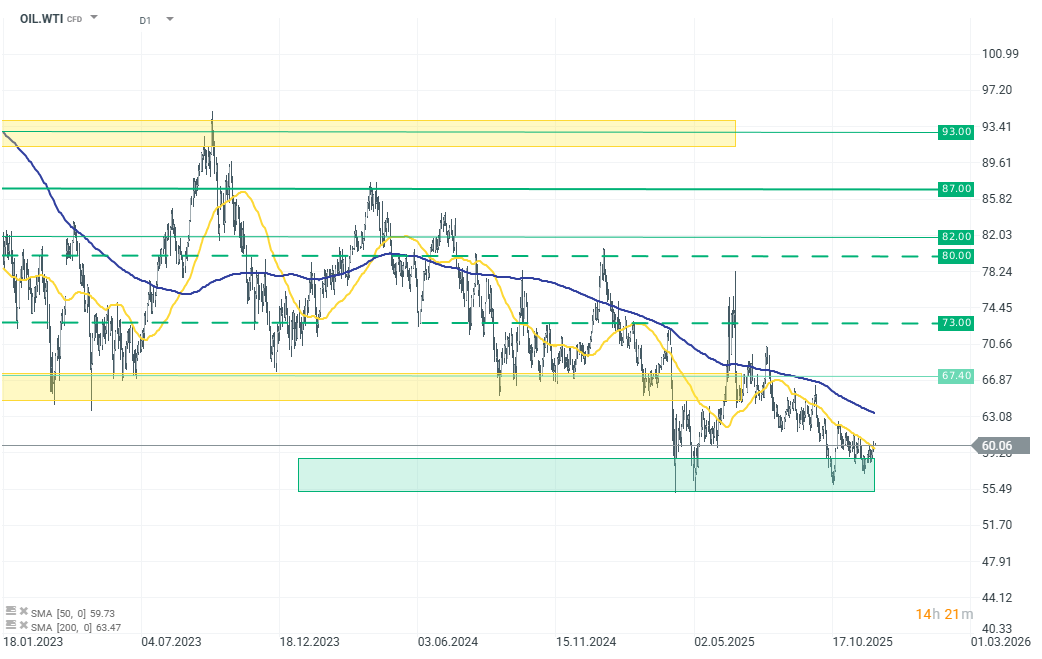

WTI crude prices have stabilized around 60–61 USD per barrel. The market is trying to balance India’s renewed purchases of discounted Russian oil with concerns about global oversupply. India is once again buying crude through intermediaries at a deeper discount of around 5 USD per barrel, and President Putin has pledged “uninterrupted fuel supplies” as part of expanded economic cooperation. The renewed India–Russia trade partnership provides steady demand for Russian barrels at a time when OPEC+ and non-cartel producers — such as the U.S., Brazil, and Guyana — are increasing output.

At the same time, Ukrainian attacks on Russian energy infrastructure — including strikes on refineries, ports, and the CPC Black Sea export terminal — are putting upward pressure on physical crude prices and sharply raising shipping insurance rates in the Black Sea, in some cases by more than 200–250%. These disruptions constrain regional supply and discourage shippers, although the broader crude market remains calmer. Given these developments, oil prices continue to trade in a relatively stable range slightly above 60 USD per barrel.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)