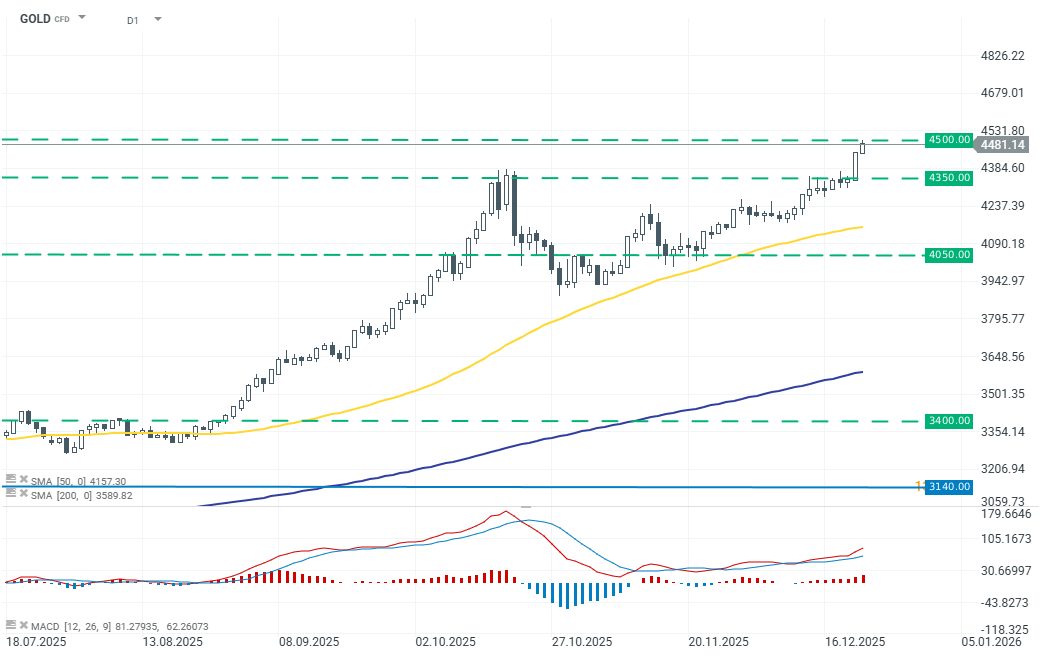

Gold continues its wave of dynamic gains, adding 0.82% today. The price of gold briefly approached another major milestone at 4,500 USD per ounce (4,495 USD). The rally is supported by a clear increase in demand for safe-haven assets and ongoing geopolitical turbulence during Donald Trump’s presidency. The immediate catalyst remains rising geopolitical uncertainty, including tensions between the US and Venezuela, which are curbing risk appetite.

Investors are also increasingly positioning for a more dovish Fed stance in 2026, supported by recent US inflation readings that came in below expectations.

From a technical perspective, gold futures have broken through a key resistance level around 4,350 USD, aligning with the prevailing upward channel. Holding above this level will be crucial to sustaining the current rally. At the same time, the prospect of further monetary easing lowers the opportunity cost of holding gold relative to yield-bearing assets. Combined with continued purchases by central banks — particularly in emerging markets — and growing interest from retail investors, this keeps structural demand for gold elevated.

Morning Wrap - Oil price is still elevated (07.03.2026)

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺