- Precious metals extend their deepest correction in months

- On a monthly basis gold still remains up 5.8%

- The closest historical parallel to the current situation was July–August 2011

- ETF funds continue to accumulate

- Precious metals extend their deepest correction in months

- On a monthly basis gold still remains up 5.8%

- The closest historical parallel to the current situation was July–August 2011

- ETF funds continue to accumulate

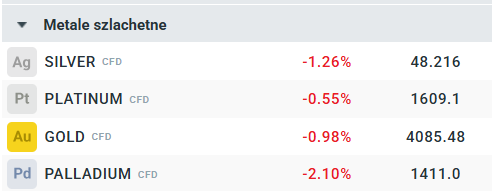

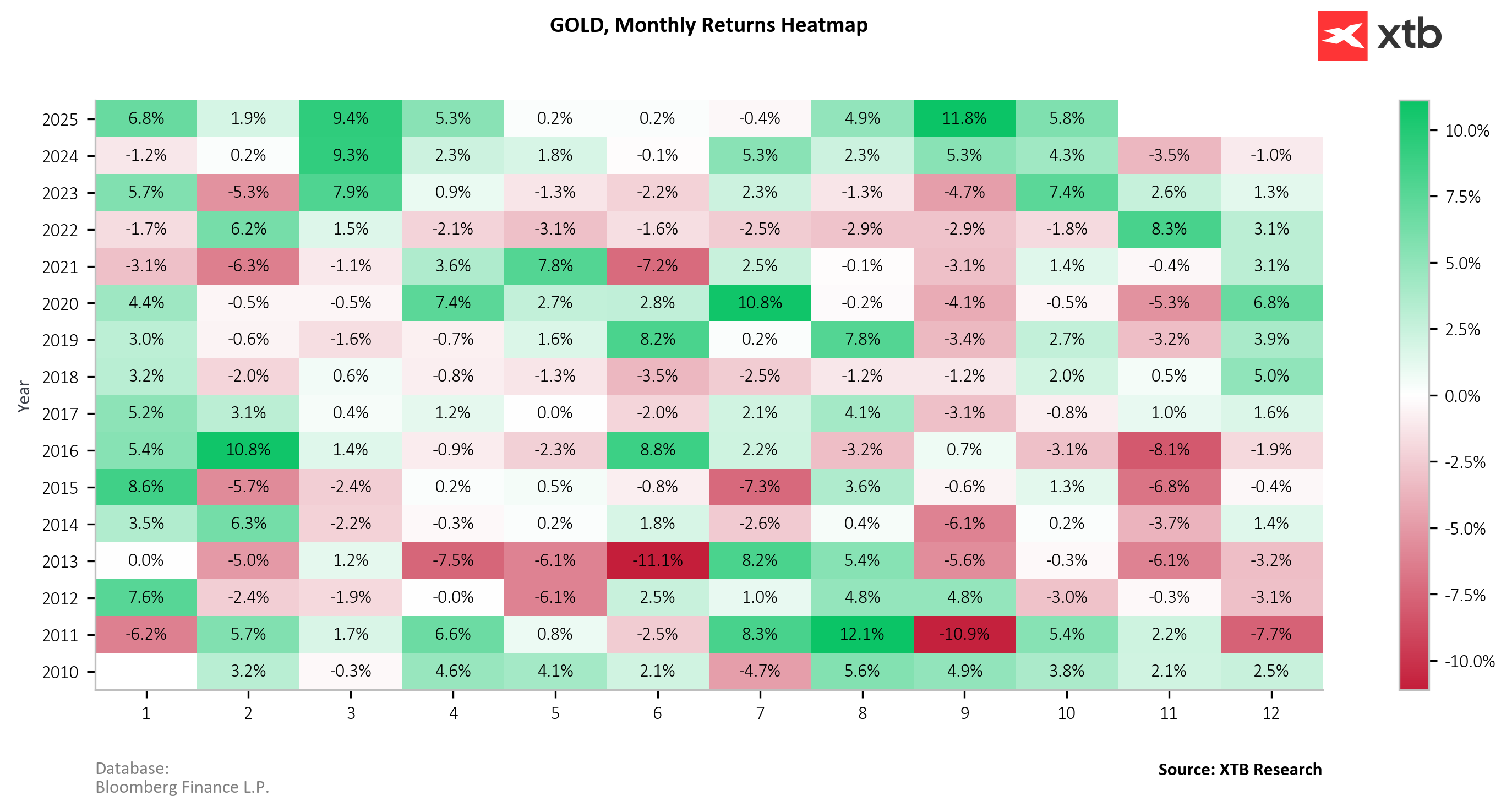

Precious metals extend their deepest correction in months. As of publication time today, gold is down another 1.00% to $4,085, silver falls 1.26% to $48.20, platinum declines 0.55% to $1,609, and palladium drops the most — 2.10% to $1,411. During the current correction, gold has lost a total of 6.50%, while silver is down 11.60%. Nevertheless, recent gains were so significant that on a monthly basis gold remains up 5.8%. Before the correction began, gold recorded two consecutive months of double-digit gains, a rare occurrence over the past 15 years of data.

The closest historical parallel to the current situation was July–August 2011, when gold rose 8.3% and then 12.1% month-over-month. In the following month — September — gold dropped 10.9%. The current setup is even more extreme, as gold has not only rallied sharply in the past two months but has also posted strong year-to-date gains. However, the macroeconomic and geopolitical environment is now substantially different.

Still, at levels above $4,300 per ounce, we observed a surge in retail buying, which may act as a contrarian signal. While long-term fundamentals remain supportive, seasonality and technical analysis point to a possible local top and a flat year-end performance. Meanwhile, ETF funds continue to accumulate, but on the Shanghai exchange, there has been a sharp reduction in long positions and a decline in silver inventories, which may suggest profit-taking.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report