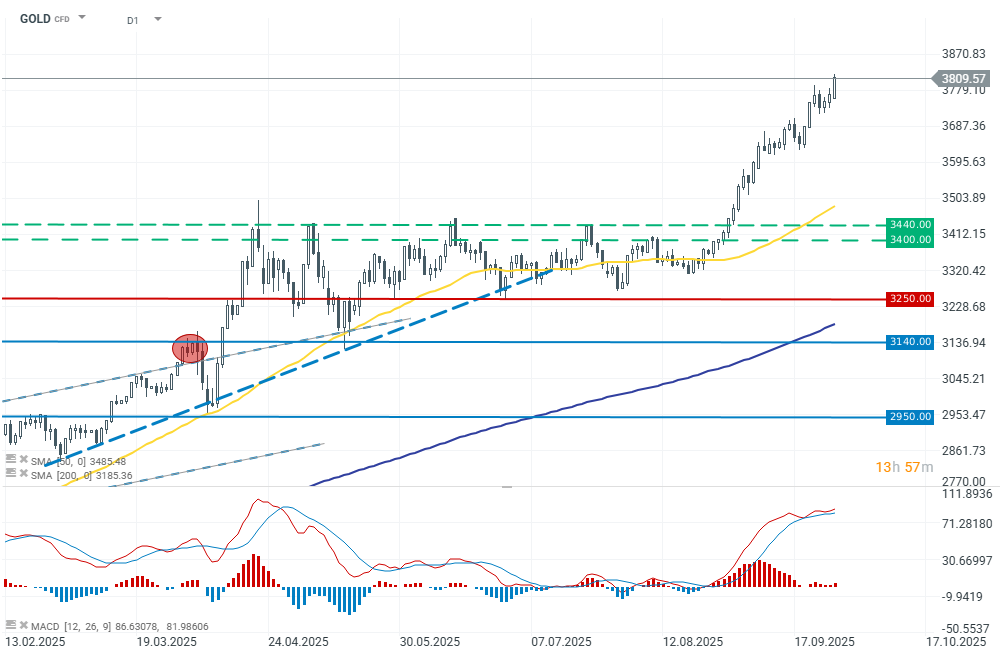

Gold is gaining 1.10% today and breaking above $3,800 per ounce. December futures are also rising to $3,840. The main reason for such strong capital inflows at the very start of the week is the flight to safety amid uncertainty linked to the looming U.S. government shutdown, reinforced by expectations of Fed rate cuts and a weaker dollar. Silver and platinum are gaining even more.

Currently, the market is pricing in a 90% probability of a 25 bp cut at the next meeting and a 68% probability at the December meeting. The risk of a U.S. government shutdown remains a short-term factor. Funding expires at midnight on September 30 if politicians fail to reach an agreement. Markets still price elevated shutdown risk, though lower than over the weekend. Republicans have assured they will not make concessions on passing a short-term funding bill. Tensions escalated when the White House Office of Management and Budget last week instructed agencies to prepare mass layoff plans in the event of a shutdown.

At present, Republicans are trying to push through a so-called “stopgap” bill until November, while Democrats want to reverse recent healthcare/Medicaid cuts before supporting legislation. Congressional leaders are set to meet with President Donald Trump for mediation. A shutdown could delay the release of key macro data, including labor market figures later this week.

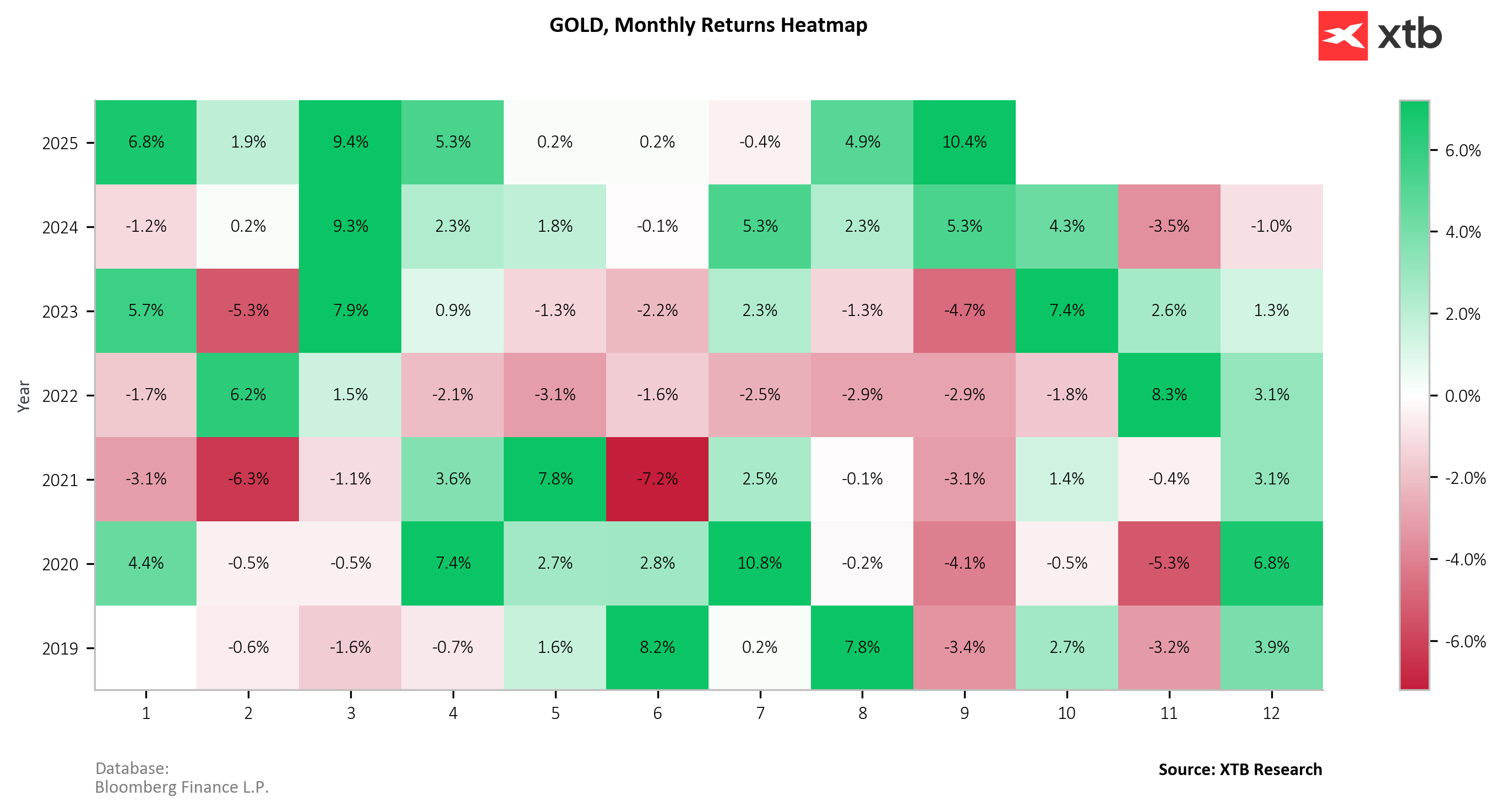

With gold up more than 45% year-to-date, over 10% this month, and the dollar down more than 9.50% this year, concerns about de-dollarization and skepticism toward Fed independence are boosting gold’s appeal as a safe haven. Strong demand for gold continues among institutions and central banks. Singapore and Hong Kong are expanding vaults, while China is increasing its reserves.

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause