US natural gas prices launched the new week with another drop. NATGAS declines over 3% today and was trading below $1.55 per MMBTu for the first time since late-June 2020. Weather forecasts continue to point to above-average across the majority of mainland United States, including in key heating regions. It becomes more and more evident that the 'proper winter' may not arrive in the United States in the remainder of this season and demand for natural gas from heating will remain subdued.

Source: NOAA

Source: NOAA

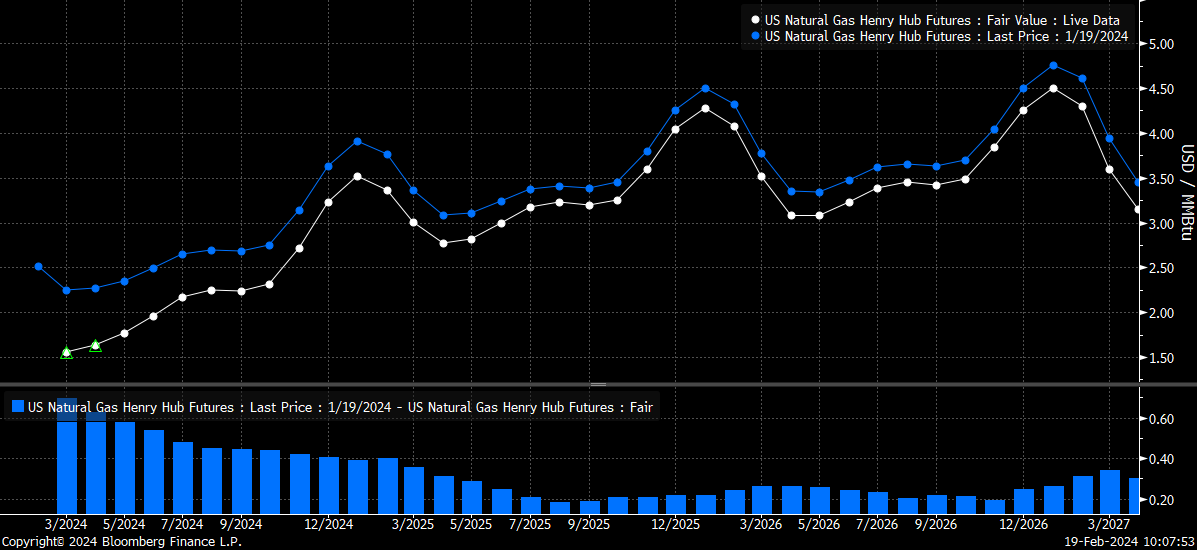

Meanwhile, natural gas production remains high and inventories are being drawn at a slower pace than usually at this time of the year. Futures curve also highlights that near-term demand outlook is weak. While a downward shift can be spotted across all the curve compared to a month ago (blue line on chart), this drops was much bigger at the short end of the curve.

Source: Bloomberg Finance LP

Source: Bloomberg Finance LP

NATGAS launched new week with a bearish price gap and drops to the lowest level since late-June 2020. Price plunged by over 50% off the early-January 2024 peak and is threatening to take out 2020 lows in the $1.50 per MMBTu area. Fundamental short-term outlook remains bearish and a break below this psychological barrier cannot be ruled out.

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉