Comments from the Russian president triggered a spike in European natural gas prices yesterday. Putin said that it has ordered Gazprom to prepare for accepting only RUB payments for natural gas from the so-called "unfriendly states". Putin said that recent EU and US sanctions do not make EUR and USD trustworthy currencies and therefore trading will be conducted in rubles. This is of course an attempt to avoid sanctions. However, it's easier said than done as it would require change of contracts that would need to be approved by both parties of the deal. Unless the Russian counterparty agrees to paying in rubles, requiring payments to be made in currency other than state in contract would technically be a default. Blame game would likely follow but in any case, the risk of halting Russian natural gas flows to Europe becomes more and more real.

However, this could be a chance for US natural gas (NATGAS on xStation). The United States plan to help the EU cut its dependence on Russian commodities and an announcement of increased shipments of US LNG to Europe may be announced as soon as tomorrow. US natural gas prices were also on a rise recently but the scale of increases was not as big as in case of European prices.

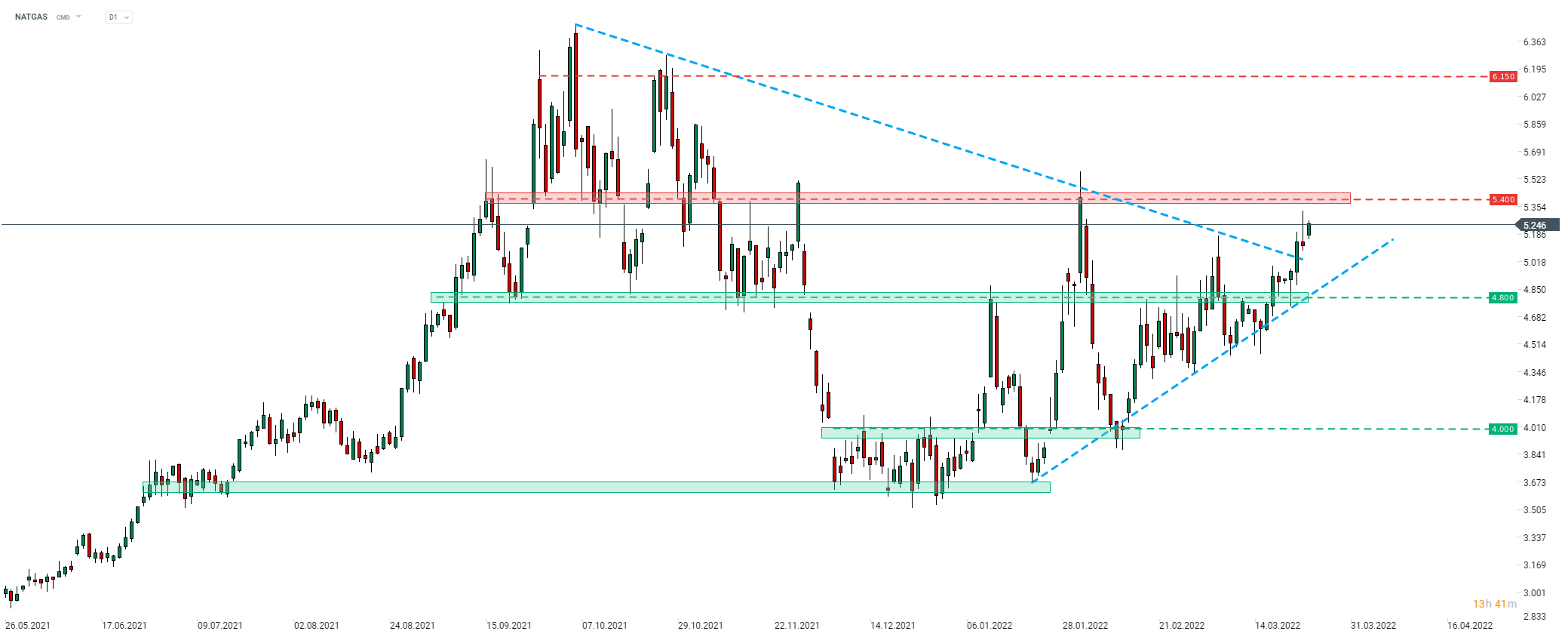

Taking a look at NATGAS chart at D1 interval, we can see that the price broke above the downward trendline and is now approaching a resistance zone, marked with late-January highs in the 5.40 area. A break above could pave the way for a retest of late-2021 highs above 6.15.

Source: xStation5

Source: xStation5

Daily Summary – Bessent Rescues the Dollar, Fed Delivers Hawkish Pivot

OIL near technical resistance zone amid EIA inventories report 🔎

Gold surges 2% testing $5300 level amid weakening US dollar 📈

Daily summary: Wall Street and EURUSD rise ahead of tomorrow’s Fed decision 🗽 Oil gains