It has been quiet about dairy prices on the market for some time. New Zealand dollar has been driven mainly by the actions of RBNZ and moves on the USD market. However, the situation may be about to change as commodities are becoming increasingly important nowadays.

Changes in dairy prices, which New Zealand is the world's biggest exporter, have been quite small for a long time. However, GDT index (Global Dairy Trade index) jumped 15% yesterday, while the whole milk powder price increased 21% at yesterday's auction.

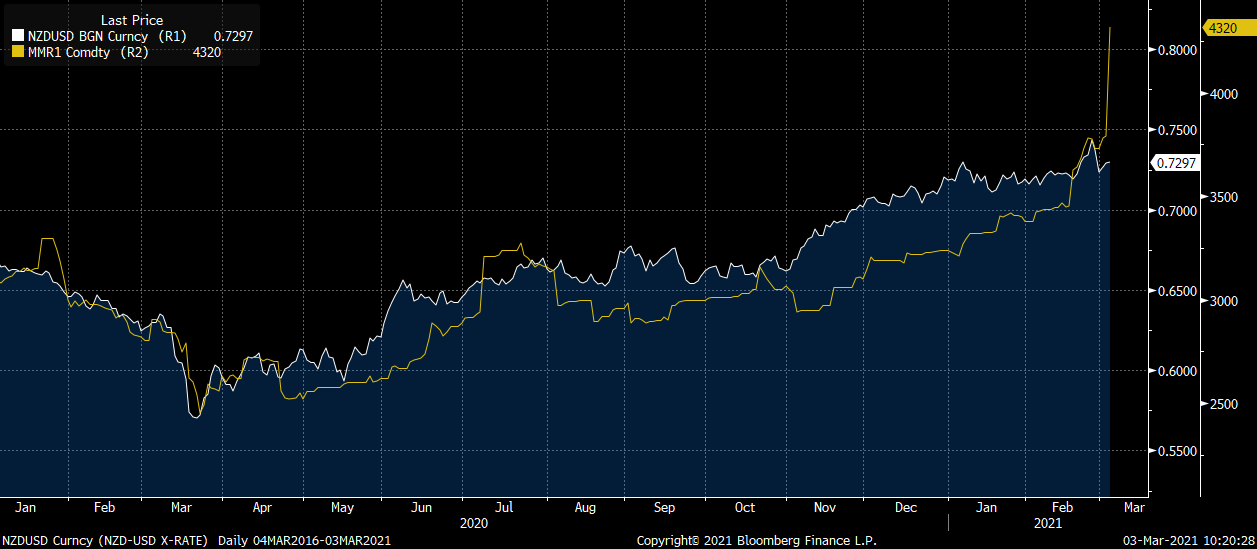

Such a high prices have not been seen since 2014 and the whole upward move starts to look similar to the one from 2012, when dairy prices jumped to almost $6,000 per tonne. NZDUSD jumped from 0.75 to 0.85 in the 2012-2013 period. As we can see on the charts below, the pair has some for further increases.

Dairy prices reached the highest levels since 2014 and current situation starts to resemble the one from 2012. Source: Bloomberg

Dairy prices reached the highest levels since 2014 and current situation starts to resemble the one from 2012. Source: Bloomberg

Dairy market has been much more dynamic than FX market recently. The next dairy auction is likely to draw the attention of FX traders and moves on the NZD market may begin ahead of the auction as market starts to price in expectations. Source: Bloomberg

Dairy market has been much more dynamic than FX market recently. The next dairy auction is likely to draw the attention of FX traders and moves on the NZD market may begin ahead of the auction as market starts to price in expectations. Source: Bloomberg

NZDUSD pulled back from ani important resistance zone marked with local peaks from 2016 and 2017. However, as commodity prices continue to rise, NZD bulls are probably not done yet. Source: xStation5

NZDUSD pulled back from ani important resistance zone marked with local peaks from 2016 and 2017. However, as commodity prices continue to rise, NZD bulls are probably not done yet. Source: xStation5

Three markets to watch next week (13.02.2026)

⏬EURUSD softens ahead of the US CPI

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Chart of the Day: USD/JPY highly volatile ahead of US CPI