A very interesting week for oil has begun. OPEC+ decided to leave policy and output levels unchanged at a virtual meeting yesterday. Such a decision was expected as oil producers want to see the impact of new Western sanctions before they make a move. EU ban on Russian seaborne oil imports and G7's $60 per barrel price cap on Russian oil are going live today, and there is a lot of uncertainty over what it means for markets. On one hand, Russia warned it will not supply oil to countries that embrace Western price cap, even if it means it will have to cut production levels. On the other hand, the price cap was set at a rather soft level and some EU countries were also granted exceptions when it comes to limits on seaborne imports of Russian oil.

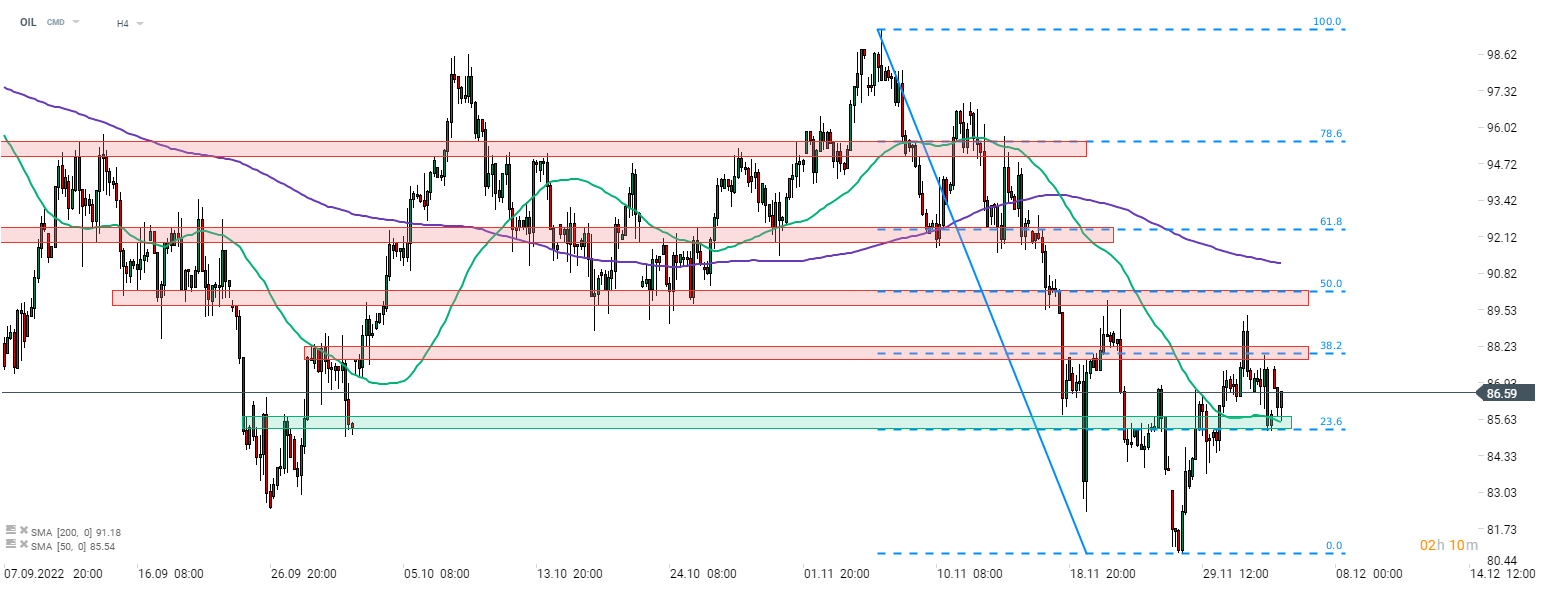

While Brent (OIL) launched this week's trading with a bullish price gap, the gain was almost completely erased and price tested support zone marked with 23.6% retracement and 50-period moving average (H4 interval, green line). An attempt to launch a recovery move can be observed at press time but crude continues to trade below overnight highs. A near-term resistance zone to watch can be found ranging around 38.2% retracement ($88 per barrel area).

Source: xStation5

Source: xStation5

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74

US Raises Tariffs to 15%

Gold and silver rebound after the sell-off 📈